Calculate Social Security Benefit : Social Security’s official calculators (Quick Calculator, Retirement Estimator/Detailed Calculator, Online Benefits Calculator, and the Retirement Age tool) are the most accurate place to start — they use your actual earnings record when you sign into your my Social Security account. Use the SSA tools when you can; the embedded estimator below gives a friendly approximate result for quick planning. (USAGov, Social Security)

What affects your Social Security retirement benefit?

- Your lifetime earnings (SSA uses your 35 highest indexed years).

- When you start benefits — anytime from age 62 up to 70 (delaying raises monthly benefits; claiming early reduces them).

- Spousal or survivor benefits — in many households you may be eligible for a spouse’s or survivor’s benefit instead of (or in addition to) your own. (Social Security)

Want the most accurate estimate? Sign into your my Social Security account and use the SSA calculators — they read your earnings record to compute AIME and PIA precisely. (Social Security)

Key technical terms (short)

- AIME (Average Indexed Monthly Earnings): SSA indexes your earnings and averages the highest 35 years, then divides by 12 to get AIME.

- PIA (Primary Insurance Amount): The formula applied to AIME (using “bend points”) that determines the benefit at full retirement age (FRA). For workers becoming eligible in 2025 the PIA bend points are $1,226 and $7,391 (90% of first $1,226; 32% of the amount between $1,226 and $7,391; 15% above $7,391).** That’s the base SSA formula we use for the estimator. (Social Security)

- Full Retirement Age (FRA): FRA depends on birth year (for people born 1960 or later FRA = 67; earlier birth years have earlier FRA). Use SSA’s Retirement Age Calculator for exact month/year. (Social Security)

Which official calculators to use (and when)

- Quick Calculator — fast, approximate estimate; no account required. Good for ballpark numbers. (Social Security)

- Retirement Estimator / Online Benefits Calculator — more accurate if you enter your actual past earnings; Online/Detailed Calculator is best when you can supply your full earnings history. (Social Security)

- Earnings Test Calculator — shows how working while receiving benefits affects checks if you’re below FRA. (Social Security)

How claiming age changes your monthly benefit (rules used by the estimator)

- Claiming before FRA (earliest 62) reduces benefits. SSA reduction is calculated monthly (the estimator uses the SSA rule: 5/9 of 1% per month for the first 36 months early, and 5/12 of 1% per month beyond 36 months).

- Claiming after FRA (up to age 70) increases benefits via delayed retirement credits (about 8% per year, or 2/3 of 1% per month).

These are the standard SSA rules used by the calculators and by the embedded estimator below. (Social Security)

Important limitations — please read

- The embedded calculator below is a planning tool and not an official SSA calculation. It estimates AIME by assuming an average annual earnings value represents your indexed average over 35 years. For an official estimate that uses your exact earnings history, sign into my Social Security and use SSA’s calculators. (Social Security)

- This estimator does not include COLA adjustments, taxes, potential Windfall Elimination Provision (WEP) or Government Pension Offset (GPO) effects (if you have a non-Social Security pension), spousal-survivor coordination, or state supplements. It also assumes 2025 PIA bend points for the PIA step. Use it for quick comparisons (claim at 62 vs FRA vs 70), not final decisions. (Social Security)

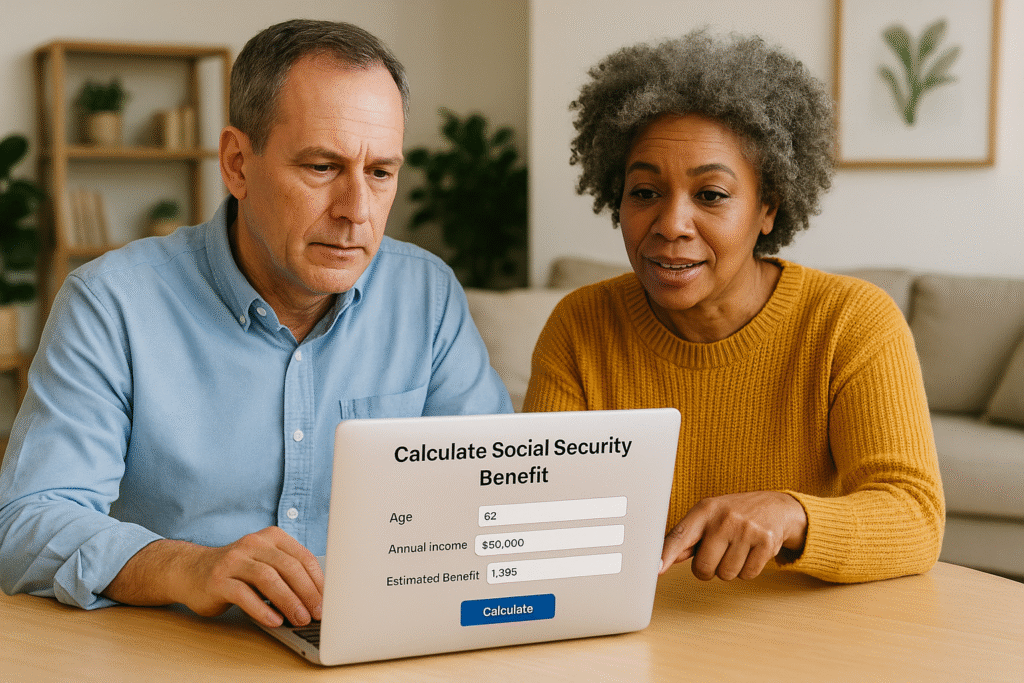

Quick Social Security Benefit Estimator

Enter an average annual earnings figure (approximate average of your highest 35 years) and the age you plan to claim. This gives a quick, **non-official** estimate using 2025 SSA bend points.

How the embedded estimator works

- You enter an average annual earnings number (this stands in for SSA’s indexed average of your top 35 years).

- The script converts that to AIME by dividing by 12.

- It applies the 2025 PIA bend points (first $1,226 at 90%, next portion at 32%, remainder at 15%) to get the PIA — the monthly amount at FRA. (Social Security)

- It adjusts that PIA up or down depending on whether you plan to claim early (reductions) or delay until after FRA (delayed credits up to age 70). (Social Security)

Practical example

- If your average annual earnings ≈ $60,000, AIME ≈ $5,000. Using the 2025 bend points the estimated PIA will come out roughly to a figure you can compare across claim ages (the embedded calculator will compute the exact estimate for you). For the most precise number tied to your exact earnings, use SSA’s Online Calculator after signing in. (Social Security)

Next steps — how to refine the estimate

- Create a my Social Security account and use the SSA Online/Detailed Calculator — it uses your real, indexed earnings history (best accuracy). (Social Security)

- If you have a pension from non-covered government work, investigate WEP/GPO impacts (those reduce or offset benefits). Consult SSA or OPM guidance for WEP/GPO rules. (U.S. Office of Personnel Management)

- Combine Social Security estimates with your 401(k)/IRA/other savings projections to build a full retirement income plan.

Helpful official links (only external links in this post — clickable)

- USA.gov overview — Social Security calculators (official starting point).

https://www.usa.gov/social-security-calculators (USAGov) - SSA — Benefit Calculators main page (Quick Calculator, Detailed/Online Calculator, Earnings Test, etc.).

https://www.ssa.gov/benefits/calculators/ (Social Security) - SSA — Quick Calculator & Online/Detailed Calculator pages.

Quick Calculator: https://www.ssa.gov/OACT/quickcalc/

Online/Detailed Calculator instructions: https://www.ssa.gov/benefits/retirement/planner/AnypiaApplet.html (Social Security) - SSA — Bend points / PIA formula (used by this estimator — 2025 bend points $1,226 and $7,391).

https://www.ssa.gov/oact/cola/piaformula.html (Social Security)

Disclaimer

This article and the embedded estimator are informational only and not a substitute for the Social Security Administration’s official calculators or legal/financial advice. For an exact benefit estimate tied to your full, indexed earnings record, sign into my Social Security and use the SSA Online/Detailed Calculators. Rules, bend points, and thresholds change; this post is current as of September 2025. Images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes. (Social Security)