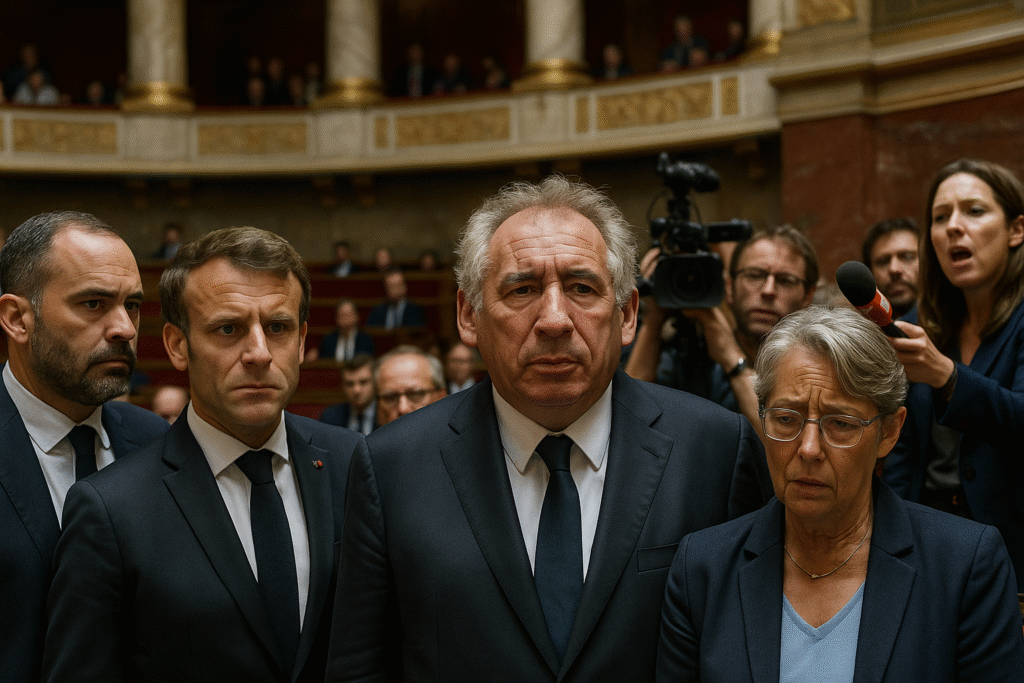

French government collapsed 2025: Quick summary (one line): France’s government collapsed on 8–9 September 2025 after Prime Minister François Bayrou lost a confidence vote in the National Assembly — a shock that deepens political paralysis in Paris, rattles markets and forces President Emmanuel Macron to find a new prime minister or consider snap elections. This explainer walks you step-by-step through the facts, the reasons, the immediate effects (including market signals), and the realistic options ahead.

1) The facts — what happened, exactly

On 8 September 2025 France’s lower house of parliament voted 364–194 to deny confidence to Prime Minister François Bayrou’s government. Bayrou must now tender his resignation, and President Emmanuel Macron is tasked with appointing a successor — the fifth prime minister in under two years as political instability persists. The vote followed a heated parliamentary debate and came after Bayrou had staked his tenure on an austere budget plan.

2) Why the government collapsed — the immediate causes

Two connected drivers explain the fall:

- A contentious austerity plan (budget fight). Bayrou had pressed a tough package of spending cuts to reduce a ballooning public debt (reported at roughly €44 billion in planned cuts). The measures were deeply unpopular across the political spectrum and provided the trigger for opponents to unite against him.

- A fragmented, polarized National Assembly. Since snap elections and political realignments last year, no single majority controls parliament. Left, far-right and various centrist blocs often disagree — and that fragmentation makes passing painful but necessary fiscal measures politically hazardous. Bayrou’s minority cabinet could not secure the cross-bench support it needed.

3) Why this matters — the immediate political impact

- Macron’s government faces a credibility crisis. Repeated collapses make it harder for the presidency to govern and to implement big reforms; each new prime minister has less political capital.

- Policy paralysis on budget and reforms. Passing the 2026 budget was Bayrou’s central task; with him gone, budget planning and debt-repair measures are in limbo — a real problem given France’s high debt ratio.

- Street politics: large protests and strike threats (the “Let’s Block Everything” movement and unions) are already mobilizing — raising the chance of disruptive demonstrations in coming days.

4) What markets and Europe are saying — financial impact

Markets reacted cautiously: French bond yields widened versus German Bunds as investors priced higher fiscal and political risk; equities were mixed (some European indices shrugged off the shock), but bond investors remain jittery because political paralysis complicates France’s plan to rein in debt. A sustained deadlock risks higher borrowing costs and could draw scrutiny from rating agencies.

5) What Macron can do now — realistic options (and limits)

President Macron has several constitutional and political paths, each with pros and cons:

- Appoint a new prime minister quickly. The most immediate move: name a successor who can run a caretaker cabinet and try to forge ad hoc majorities for the budget. This is politically least disruptive in the short term but may fail if the new PM cannot win parliamentary support.

- Seek a cross-party pact or technocratic cabinet. Macron could pick a technocrat or seek a broad agreement — but cross-party bargains are hard in a polarized Assembly and may be politically costly to all sides.

- Dissolve the National Assembly and call snap elections (Article 12). The president may dissolve parliament and trigger new legislative elections, but that is risky: recent snap votes have strengthened anti-establishment forces, and another dissolution could further destabilize Macron’s position and the country. Constitutional rules (Article 12) require consultation and carry limits (for example, timing constraints). Historically this is a high-stakes lever.

Each option has political and economic trade-offs; Macron has, so far, resisted immediate dissolution — but continuing gridlock would make it harder for any government to pass tough fiscal measures.

6) Broader strategic consequences — for the EU and geopolitics

- France’s influence in Europe may be dented. A weakened, distracted Paris has less bandwidth to lead EU coordination on defense, migration or budget rules — giving room for other capitals to shape the agenda.

- Eurozone fiscal confidence is tested. France is the eurozone’s second-largest economy; prolonged instability raises concerns about fiscal discipline across the bloc and could complicate ECB policy and bond markets.

7) What to watch in the next 72 hours (actionable, date-sensitive signals)

- Who Macron chooses as PM. Personality and parliamentary skill matter: a consensus figure could calm things; a polarizing pick will inflame opponents.

- Statements from major party leaders. Will left unions, the New Popular Front, National Rally, or centrist blocs back any compromise? Their answers determine whether a workable majority exists.

- Bond yields and ratings commentary. Watch the spread between French and German 10-year bonds and any Fitch/Moody’s commentary — widening spreads signal market concern.

- Protests and strikes. Union calls and mass-action plans (dates and scope) will show how volatile the street picture could become.

8) How ordinary people are likely to be affected

- Short term: public services continue (caretaker government), but uncertainty can delay spending programs, hiring and investment decisions.

- Medium term: if a stable fiscal plan is delayed, projects (local government budgets, social programs) could be scaled back or postponed; higher bond yields would raise borrowing costs across the economy.

9) What would stabilize the situation?

- A credible budget roadmap with realistic deficit targets and a fair mix of spending cuts and revenue measures that win cross-bench support.

- A durable parliamentary pact — even a time-limited coalition or confidence-and-supply arrangement — that allows the state to function and markets to breathe.

- Political calm and dialogue that reduce disruptive street action and reassure investors and EU partners. These outcomes require compromise — politically difficult but economically necessary.

10) Bottom line — the big-picture takeaway

The French government collapsed 2025 is not just a headline: it is a structural symptom of a fragmented political order and a high-stakes clash over how to deal with rising public debt. Short-term fixes (a new PM or technocratic cabinet) could buy time, but without a workable parliamentary majority and a credible fiscal plan, instability will keep returning — with consequences for France’s finances, its role in Europe, and the daily lives of citizens.

Sources & further reading (authoritative reporting used here)

- Reuters — “French parliament ousts prime minister, deepening political crisis.” (Reuters)

- Al Jazeera — “French government collapses after PM Bayrou ousted in vote.” (Al Jazeera)

- The Guardian — live reporting and analysis on Bayrou’s fall and Macron’s options. (The Guardian)

- Reuters / Bloomberg market coverage and analysis of bond / investor reaction. (Reuters, Bloomberg.com)

- France24 / Constitution resources — explanation of Article 12 and dissolution mechanics. (France 24, Constitutional Council)

Disclaimer (Google AdSense–friendly)

This article synthesizes reporting and expert commentary available as of September 2025. It is for informational and journalistic purposes only and does not represent official government statements or legal advice. For immediate developments consult the primary news wires (Reuters, AFP), French official announcements, and expert analyses as events evolve. Images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.