Buying a home in 2025 means balancing rising home prices, shifting interest rates, and a confusing stack of loan types and government rules. This deep-dive, step-by-step guide explains the mortgage options (fixed vs adjustable), what mortgage rates today mean for your buying power, how to qualify, and where to get official, authoritative information. It’s written for U.S. homebuyers and verified with government and industry sources as of August 17, 2025.

Why “mortgage rates today” matters — quick primer

“Mortgage rates today” is not just a headline — it directly changes your monthly payment and how much home you can afford. For example, a 30-year fixed rate of 6.58% vs 5.5% can change monthly payments by hundreds of dollars on the same purchase price. Market-driven rate moves, lender pricing, and loan type all interact to determine the actual interest rate you’ll pay. For weekly national averages, see Freddie Mac’s Primary Mortgage Market Survey. (Freddie Mac)

1) Common mortgage types

- 30-year fixed-rate mortgage — Same interest rate and monthly principal+interest payment for the life of the loan. Best for predictability and long-term homeownership. (Freddie Mac tracks national averages for this product.) (Freddie Mac)

- 15-year fixed-rate mortgage — Higher monthly payment than a 30-year on the same loan amount, but much faster principal paydown and lower total interest cost.

- Adjustable-Rate Mortgage (ARM) — Lower initial fixed-rate period (commonly 5, 7, or 10 years), then rate adjusts periodically based on an index plus margin. Good if you plan to sell/ refinance before the adjustment or expect rates to fall. Read the CFPB’s guide to understand adjustment caps and index definitions. (Consumer Financial Protection Bureau)

- FHA loans — Backed by HUD, these allow lower down payments and more flexible credit rules but include mortgage insurance. FHA loan limits vary by county. Use HUD’s FHA mortgage limits lookup for local numbers. (ENTP HUD, FHA)

- VA loans — For veterans and eligible service members; often no down payment and competitive rates. Follow VA official guidance for eligibility and benefits. (Benefits)

- USDA loans — For eligible rural buyers with low-to-moderate income, sometimes offering no-down-payment options through the USDA Guaranteed or Direct loan programs. Check USDA Rural Development for eligibility and current program details. (Rural Development, Default)

- Conventional conforming loans (Fannie/Freddie) — Conforming to FHFA loan limits and underwriting standards; typically require higher credit scores and down payments than government programs. FHFA publishes the conforming loan limits each year. (FHFA.gov, Fannie Mae)

2) Fixed vs Adjustable — how to choose

When a fixed-rate mortgage is better

- You plan to live in the home long-term (10+ years).

- Predictable budget is a must.

- You want protection if rates rise.

When an ARM might make sense

- You expect to sell or refinance before the initial fixed period ends (e.g., a 5/1 ARM where the rate is fixed for 5 years).

- You want lower initial payments to free up cash for renovations, paying down debt, or investing.

- You understand caps, index risk, and have an exit strategy if rates move higher. CFPB’s resources explain ARM mechanics and consumer protections. (Consumer Financial Protection Bureau)

Hybrid approach

- Some buyers lock a portion of their borrowing in a fixed loan and use other savings or HELOC for short-term cash flexibility. Talk to lenders and housing counselors (HUD-approved) before mixing products. (HUD Housing Counselors)

3) What determines “mortgage rates today”?

- Treasury yields & long-term bond markets: Mortgage rates generally follow bond markets — when bond yields rise, mortgage rates often do too.

- Inflation expectations and central bank policy: Higher inflation expectations push rates up.

- Lender pricing, borrower credit profile, and loan characteristics: Your credit score, down payment size, loan-to-value (LTV), and loan type (e.g., FHA vs conventional) change the rate you’ll be offered. Freddie Mac and other weekly surveys report national averages; your lender quote may differ. (Freddie Mac)

4) How to qualify — the lender’s checklist

Lenders usually check these items when underwriting a mortgage:

- Credit score & credit history — Higher scores mean better pricing. Minimums vary by product (FHA, VA, USDA, conventional).

- Income & employment history — Stable employment and documented income are critical. Lenders will verify recent paystubs, W-2s, tax returns, or 1099s for gig income.

- Debt-to-Income Ratio (DTI) — Most lenders prefer front-end (housing) DTI and back-end (total debts) DTI under certain thresholds (varies by loan program). CFPB and HUD have buyer resources to estimate DTI and monthly costs. (Consumer Financial Protection Bureau, HUD Housing Counselors)

- Down payment & reserves — Conventional loans often require 5–20% down; FHA allows lower down payments but requires mortgage insurance. VA and USDA may allow 0% down for eligible borrowers. (FHA, Benefits, Rural Development)

- Property appraisal & condition — Lenders require an appraisal to confirm value; some government loans have property condition requirements (FHA’s standards, USDA property eligibility). (HUD.gov)

5) What to do when “mortgage rates today” drop — timing & refinance tactics

- When to refinance: Compare the projected break-even period (closing costs ÷ monthly savings). If you plan to stay in the home longer than the break-even, refinancing can be worthwhile. Use CFPB and lender calculators to estimate. (Consumer Financial Protection Bureau)

- Cash-out refinance vs rate-and-term refinance: Cash-out reduces available equity but gives liquidity. Rate-and-term focuses solely on getting a lower rate or changing term length. CDC and HUD materials explain pros/cons for borrowers in distress. (HUD Housing Counselors, HUD.gov)

- Watch loan features: If you move from an ARM to a fixed loan through refinance, consider loan costs and the new term length. If interest rates fall to attractive levels, you may also lower loan term from 30 to 15 years for faster paydown.

6) Low-down-payment options & special programs

- FHA loans — Lower credit and down payment flexibility; check the FHA county-by-county loan limits to know allowed amounts. (ENTP HUD, FHA)

- VA loans — No down payment for eligible veterans and often low closing costs; confirm eligibility on VA’s official site. (Benefits)

- USDA loans — Zero-down options for eligible rural properties; check property eligibility and income limits on USDA Rural Development pages. (Rural Development, Default)

- Down payment assistance (DPA) and local programs — Many cities and states run assistance programs; HUD’s housing counseling directory can help you locate local resources. (HUD Housing Counselors)

7) Costs beyond interest — what to budget for

- Closing costs — Usually 2%–6% of loan amount (fees, title, appraisal, escrow). Some programs allow seller concessions to pay portions of closing costs.

- Private Mortgage Insurance (PMI) — For conventional loans with <20% down; FHA has mortgage insurance premiums (MIP). Check program pages for exact rates. (FHA)

- Property taxes, homeowner’s insurance, HOA fees, utilities — These affect total monthly housing costs and lender DTI calculations. CFPB’s “owning a home” resources list steps and expected costs. (Consumer Financial Protection Bureau)

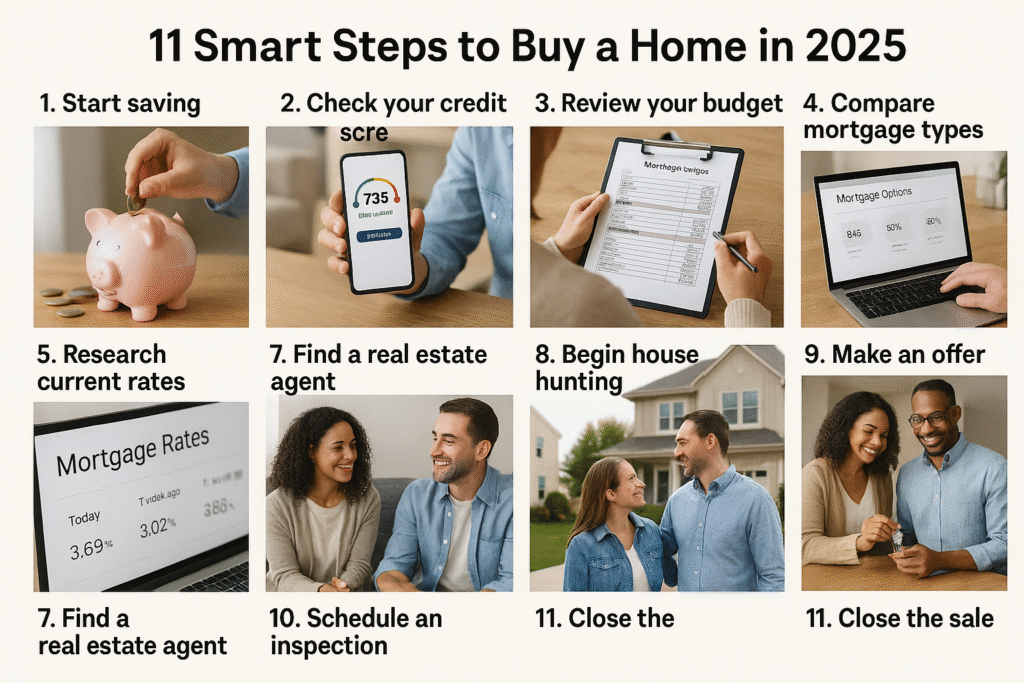

8) Simple step-by-step homebuying checklist (interactive)

- Check your credit report & score — fix errors and reduce high-interest balances.

- Save for down payment & 3–6 months of reserves — target depending on loan type and local market.

- Get prequalified or preapproved — shop multiple lenders to compare net loan costs, not just headline “mortgage rates today.” Ask for Loan Estimates from three lenders. CFPB explains how to compare Loan Estimates. (Consumer Financial Protection Bureau)

- Choose loan program — FHA, VA, USDA, conventional — based on eligibility and costs. Use HUD, VA, and USDA pages for confirmation. (FHA, Benefits, Rural Development)

- Make an offer & lock or float rates — discuss locking the rate with your lender once your offer is accepted. If you think rates will improve, floating is an option, but it’s riskier.

- Complete underwriting & appraisal — submit any requested docs promptly to avoid delays.

- Close & move — review closing disclosure, confirm funds for closing, and complete the transaction.

9) FAQs — short answers you need today

Q: How do I find the most accurate “mortgage rates today” for my loan?

A: Get written Loan Estimates from multiple lenders (same loan scenario) and compare annual percentage rate (APR), fees, and points. National averages (Freddie Mac) give context, but your personal quote depends on credit, down payment, and loan program. (Freddie Mac, Consumer Financial Protection Bureau)

Q: Do government loans always have lower rates?

A: Not always. VA and USDA sometimes offer very competitive rates and lower down payments; FHA tends to have flexible underwriting but mortgage insurance. Compare total costs including mortgage insurance and fees. (FHA, Benefits, Rural Development)

Q: Are conforming loan limits higher in 2025?

A: Yes — FHFA announced higher conforming loan limit values for 2025; check FHFA or Fannie Mae for the precise limit in your county. (FHFA.gov, Fannie Mae)

10) Where to verify rules and get official help

Below are authoritative pages (government and federally-backed agencies) that cover rates, limits, program rules, consumer protections, and local assistance. These links were verified and active as of August 17, 2025 — save them and check them when you need exact numbers, forms, or program eligibility:

- Freddie Mac — Primary Mortgage Market Survey (weekly rates, commentary): https://www.freddiemac.com/pmms. (Freddie Mac)

- Consumer Financial Protection Bureau — Owning a Home & mortgage shopping tools: https://www.consumerfinance.gov/owning-a-home/. (Consumer Financial Protection Bureau)

- HUD — FHA mortgage limits lookup and HUD homebuyer resources: https://entp.hud.gov/idapp/html/hicostlook.cfm and https://www.hud.gov/topics/buying_a_home. (ENTP HUD, HUD.gov)

- FHA (industry site with limits info — cross-check with HUD): https://www.fha.com/lending_limits. (FHA)

- VA Home Loans — official Veterans Benefits Administration home loan center: https://www.benefits.va.gov/homeloans/. (Benefits)

- USDA Rural Development — Single Family Housing programs and property eligibility: https://www.rd.usda.gov/programs-services/single-family-housing-programs. (Rural Development)

- FHFA — Conforming loan limit values and announcements: https://www.fhfa.gov/news/news-release/fhfa-announces-conforming-loan-limit-values-for-2025. (FHFA.gov)

- IRS — Publication 936, Home Mortgage Interest Deduction (tax rules for homeowners): https://www.irs.gov/publications/p936. (IRS)

- HUD Housing Counselors & local assistance directory (find HUD-approved counselors): https://www.hudhousingcounselors.hud.gov. (HUD Housing Counselors)

Final checklist before you apply (printable)

- Pull credit report & dispute errors.

- Save copies of paystubs, W-2s, tax returns (last 2 years), and bank statements.

- Contact at least three lenders and request Loan Estimates.

- Decide whether to lock or float rate after offer acceptance.

- Confirm any down payment assistance and program eligibility.

- Review closing disclosure 3 days before closing.

Disclaimer

This post is informational only and does not constitute legal, tax, or financial advice. Rules, rates, and program limits change; confirm details using the official sources listed above and consult a qualified mortgage professional, housing counselor, or tax advisor for advice tailored to your situation. All images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.