By TrenBuzz — Updated Oct 28, 2025. All data and statements below are verified from company filings and major financial outlets the morning of publication.

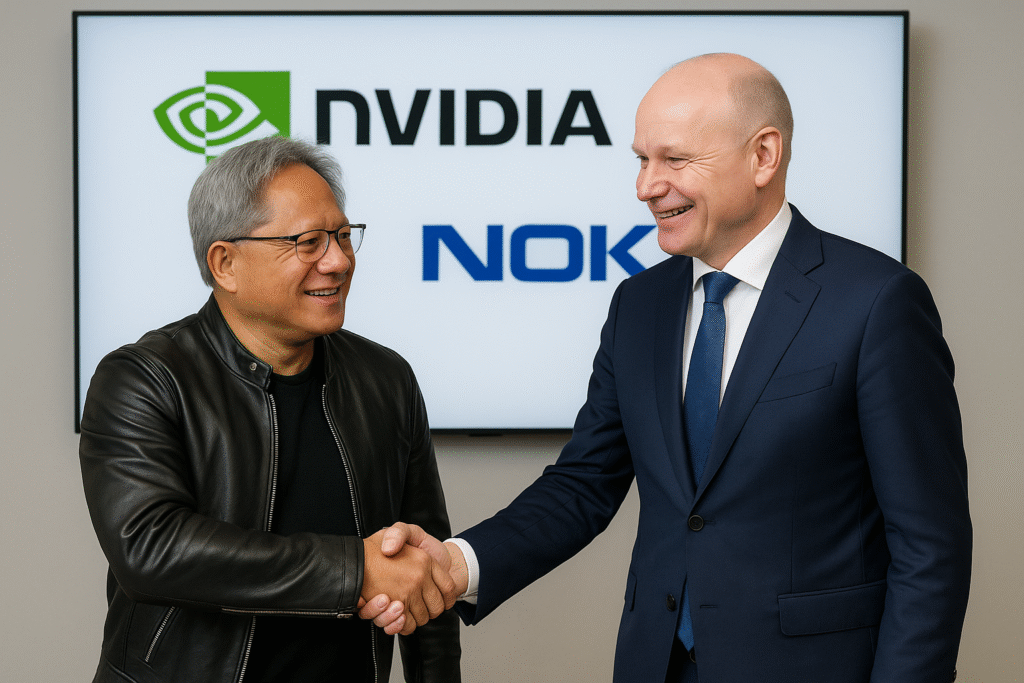

Nokia Stock 2025: NVIDIA announced a strategic partnership and a $1.0 billion equity investment in Nokia today, a move that immediately moved the market and pushed NOK shares sharply higher. The deal — plus Nokia’s better-than-expected Q3 results — rewrites some investor narratives about the Finnish telecom giant’s role in AI infrastructure and optical networks. Below I break down the facts, the market reaction, why the tie-up matters for Nokia stock (NOK), the top risks, and practical ways investors can think about the story now.

1) Nokia Stock 2025 — Nvidia’s $1B Bet: Nvidia is buying into Nokia (and why that’s huge)

NVIDIA will take a roughly 2.9% stake in Nokia by subscribing for about 166.4 million shares at $6.01 per share — a $1.0 billion subscription announced today as part of a broader strategic partnership to develop AI-native RAN (radio access network) and 6G-ready platforms. This ties Nvidia’s AI compute strengths with Nokia’s telecom and optical infrastructure.

Why it matters: the combination accelerates Nokia’s roadmap into AI-at-the-edge telco compute and gives Nokia direct access to Nvidia’s chip and AI-stack ecosystem. The market reacted positively because it signals strong strategic validation from one of the world’s largest AI vendors.

2) Nokia’s recent results — the concrete earnings beat that set the stage

Nokia reported Q3 2025 net sales of €4.83 billion, up about 9–12% YoY on comparable bases, and a comparable operating profit that beat consensus. Management cited strong demand in Optical Networks (AI and cloud data-center customers) as a key growth driver. The results helped lift investor confidence shortly before the Nvidia announcement.

Investor takeaway: Nokia’s revenue mix is shifting toward data-center and optical transport — segments that are more directly tied to hyperscaler and AI infrastructure spending than classic mobile RAN alone. That evolution helps explain why Nvidia would partner with Nokia.

3) What the market did: NOK shares and valuation moves

Following the Nvidia announcement, Nokia shares jumped double digits on heavy volume as the market priced in strategic upside and the new capital. The stock has traded in a range this year, but today’s news moved NOK back toward recent 52-week highs and reduced immediate balance-sheet concerns given Nokia’s multi-billion euro cash position and the fresh subscription proceeds. Use official market quotes for exact intraday numbers; the company reported a net cash balance of about €3.0 billion in Q3.

What to watch: stock moves can overshoot near big headlines. If you’re trading the news, watch liquidity and be prepared for volatile intraday spreads. For long-term investors, focus on how the capital and partnership accelerate revenue mix and margin improvement, not just the headline pop.

4) The strategic rationale — AI, RAN, optical networks and 6G

Nokia brings telecom-grade hardware, radio expertise and optical transport to the table; Nvidia brings chips, AI frameworks and scale in inference/training accelerators. Together they plan AI-native RAN products and 6G-ready platforms that could appeal to carriers pushing AI services into the network edge. This partnership is explicitly framed as a multi-year effort to bake AI into telecom infrastructure, which could broaden Nokia’s TAM (total addressable market) beyond classic RAN sales.

Why it matters for NOK stock: if Nokia successfully sells AI-accelerated network solutions to large carriers and hyperscalers, revenue visibility and margins could improve materially — a positive re-rating catalyst for the stock. But execution is critical.

5) How much dilution — and what shareholders should know

The Nokia board has resolved to issue the new shares to enable the directed subscription to Nvidia. The $6.01 subscription price and the size of the issuance will dilute existing shareholders to some extent — Nvidia gets ~2.9% ownership post-issuance per disclosures. Investors should review the planned share issuance details in Nokia’s corporate notice to understand timing and final dilution percentages. Dilution is a trade-off for strategic capital and a heavyweight partner; many investors will accept modest dilution if the partnership meaningfully boosts long-term cash flows.

6) The balance-sheet picture — Nokia is not cash-strapped

Nokia reported Q3 free cash flow of about €0.4 billion and a net cash balance near €3.0 billion. That cash plus the $1.0 billion subscription improves flexibility for capex into optical and data-center investments, R&D, and potential bolt-on deals. That helps the company fund growth initiatives without excessive leverage. Still, investors should monitor working capital trends and any larger M&A commitments.

7) Key risks investors must consider

• Execution risk: Integrating NVIDIA’s compute stack into telecom-grade products is complex and can take several quarters to monetize.

• Competition: Ericsson and Huawei are deep incumbents in RAN and optical that will accelerate counter-moves. Market share fights can pressure pricing.

• Regulatory / geopolitical: National security concerns about telecom infrastructure remain a wildcard, especially for cross-border partnerships in critical infrastructure.

• Market enthusiasm vs fundamentals: Stocks often overshoot on strategic headlines; a re-rating depends on tangible contract wins and margin progression.

8) What analysts are saying (short snapshot)

Initial market commentary calls today’s move a strategic validation for Nokia’s pivot into AI and cloud customer segments. Street analysts will update models to incorporate potential revenue upside from AI-RAN and optical sales to hyperscalers, but they’ll also model gradual adoption and conservative margin expansion until more contract-level evidence appears. Expect analyst target revisions in the coming days.

9) How to think about Nokia vs. pure-play AI/semiconductor names (e.g., Nvidia)

Nokia and Nvidia play different roles: NOK is a telecom and optical equipment manufacturer with recurring carrier relationships; NVDA is an AI compute and chip designer. Nvidia’s investment does not make Nokia a chip company — but it could make Nokia a preferred integrator of AI-accelerated telecom solutions. For diversified exposure to AI telecom wins, NOK offers a play closer to carriers and operators; NVDA remains a core play on the raw compute stack and software ecosystem. Allocate based on risk appetite: NOK for hardware+services telecom exposure, NVDA for pure AI compute growth.

10) Practical investor playbook — short, medium, long horizons

Short term (days–weeks): expect headline-driven volatility. Traders can use options or partial position sizing to manage risk around newsflow.

Medium term (3–9 months): look for concrete partnership announcements (carrier pilots, proof-of-concept wins, product roadmaps) and Nokia’s ability to convert optical & AI-related pipeline into backlog.

Long term (12+ months): evaluate Nokia on cash-flow conversion, margin expansion from higher-value AI/optical sales, and the company’s competitive positioning vs Ericsson/Huawei. Rebalance positions as contract-level evidence emerges.

11) Conclusion — why Nokia stock matters again

Nokia’s Q3 beat showed the company is already benefiting from optical and AI-cloud demand, and Nvidia’s $1B strategic investment is a stamp of relevance for Nokia in the AI infrastructure story. That combination makes Nokia stock (NOK) worth watching for investors who believe AI will extend beyond data centers into telecom networks. But remember — headlines are only the start; the stock will be re-rated based on execution, contract wins, and whether Nokia can translate strategic partnerships into sustained margin and cash-flow gains.