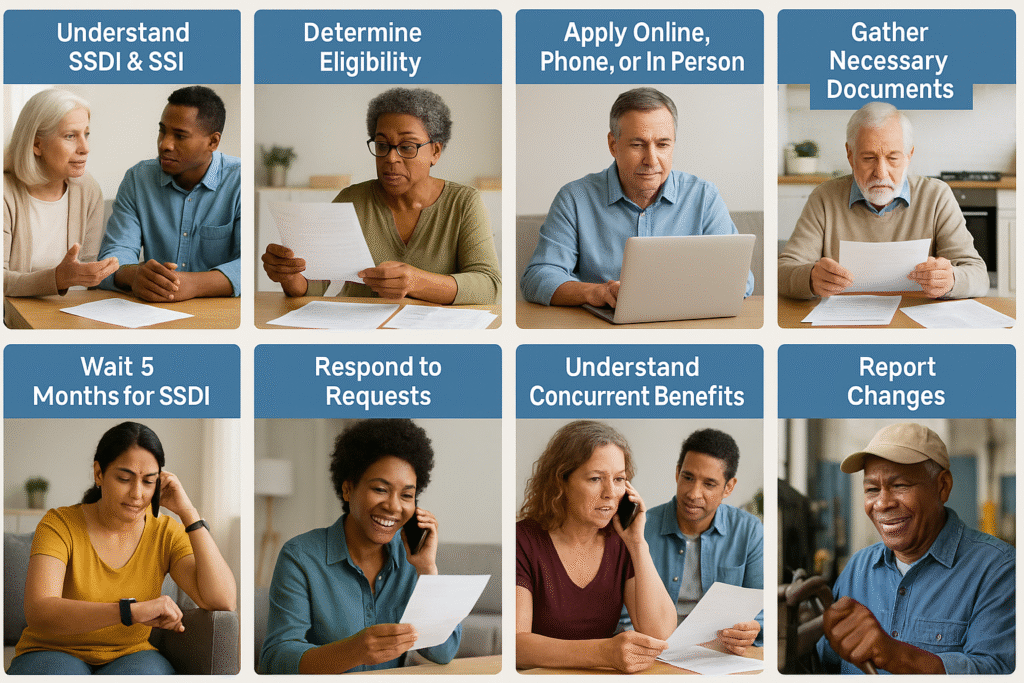

SSDI and SSI benefits for disabled and Seniors: This blog exhibits Clear, step-by-step guidance written for U.S. readers: this guide explains the difference between SSDI and SSI, who qualifies, how to apply (online / phone / in person), what documents to gather, timelines (including the SSDI five-month waiting period), how concurrent benefits work, and work-incentive rules if you try returning to work.

Quick snapshot (the essentials)

- SSDI (Social Security Disability Insurance) — benefits tied to your work history. It pays to you and certain family members if you worked, paid Social Security taxes, and meet the program’s disability rules.

- SSI (Supplemental Security Income) — a needs-based program that does not require a work history. SSI helps people age 65+ or people with disabilities who have very low income and resources.

- You can receive SSDI and SSI at the same time (called concurrent benefits) if you meet both programs’ rules.

- SSDI normally has a five-month waiting period (payments start in the sixth full month after the disability onset); SSI payments may begin sooner under its rules.

Who this guide is for

People with disabilities (adults and children) and seniors (65+) who want clear, practical steps to determine eligibility, prepare a strong application, understand payment timing, and manage benefits while working or after approval.

Step 1 — Understand the difference (short version)

- SSDI: based on your earnings record and work credits; may lead to Medicare after a qualifying period of SSDI receipt.

- SSI: based on financial need and strict resource limits; SSI is intended to cover basics like food, clothing, and housing for those with little or no income.

Step 2 — Do a quick eligibility check

- If you have a recent work history with adequate work credits and a qualifying disability, consider SSDI.

- If your monthly income and resources are very low and you are 65+ or have a disability/blindness, consider SSI.

Step 3 — Gather the documents (don’t delay your application)

Common documents you’ll need include:

- Social Security number or proof you applied for one.

- Proof of age (birth certificate, passport).

- Proof of U.S. citizenship or lawful alien status (if not U.S.-born).

- Medical records: doctors’ notes, test results, hospital records, prescription lists, and contact information for treating providers.

- Work records: W-2s, self-employment tax returns, dates and types of jobs.

- Military discharge papers (if applicable) and documents about other benefits (workers’ comp, VA awards, pensions).

If you don’t have every document, apply anyway — Social Security can often help obtain records.

Step 4 — How and where to apply (three options)

- Online — many disability and SSI applications can be started or completed online.

- By phone — call Social Security to make an appointment or start the process by phone.

- In person — visit a local Social Security office (appointments are often required); staff can help you fill out forms.

Step 5 — Timeline: what to expect after you apply

- SSDI: If approved, there’s usually a five-month waiting period; benefits begin for the sixth full month after the established disability onset date.

- SSI: Payments may begin sooner and are subject to SSI rules and any state supplementation. Some situations allow expedited or presumptive payments.

- Payment schedule: SSDI/Retirement payments are scheduled by birthdate; SSI payments are typically issued monthly (often the 1st of the month, with weekend/holiday adjustments). If a payment is late, contact Social Security right away.

Step 6 — Concurrent benefits (SSDI + SSI) and family benefits

- People who meet both sets of requirements can receive concurrent SSDI and SSI; Social Security coordinates payments so combined benefits follow program rules.

- Family benefits: In many SSDI cases, a worker’s spouse, ex-spouse (in some cases), and dependent children may also qualify for benefits based on the worker’s earnings record.

Step 7 — What happens if you return to work (work incentives)

To help beneficiaries test working again, Social Security offers work incentives such as:

- Trial Work Period (TWP) for SSDI: allows a beneficiary to try working for a set number of months while still receiving full SSDI benefits if earnings exceed certain thresholds during those months.

- Substantial Gainful Activity (SGA): if earnings exceed the SGA amount, Social Security may determine you are no longer disabled; SGA amounts are updated yearly.

- Ticket to Work: a voluntary program that connects beneficiaries (typically ages 18–64) with employment supports and providers so you can pursue work while protecting benefits and health coverage.

Step 8 — If your application is denied (appeals process)

Many initial disability applications are denied. Social Security provides multiple review levels:

- Reconsideration

- Administrative Law Judge hearing

- Appeals Council review

- Federal court review

Appeal deadlines are strict, so follow the denial letter carefully. Consider representation (a disability attorney or reputable advocate) for appeals.

Step 9 — Managing benefits after approval (use “my Social Security”)

Create a free online account to:

- Check application and appeals status, update your address and direct deposit, download benefit verification letters, and access tax forms.

Using an online account is often the fastest way to manage routine tasks without visiting an office.

Step 10 — Practical tips & checklist (before you apply)

Checklist (gather these if possible):

- Proof of identity and age.

- Social Security number or proof of application.

- Medical records and treating provider contact info.

- Work history details (employers, job titles, dates, W-2s).

- Proof of income and financial records (bank statements, rent/mortgage receipts) for SSI applicants.

Filing tips

- Apply early. Medical documentation and disability determinations take time.

- Be thorough with medical evidence. Treating-source statements and up-to-date records showing limitations strengthen claims.

- Keep copies of everything you send and a log of phone calls or office visits.

- Get help from a reputable disability advocate or attorney if your case is complex or initially denied.

Short FAQ (fast answers)

Q: Can SSDI lead to Medicare?

A: Yes — many SSDI recipients become eligible for Medicare after a qualifying period of SSDI receipt (exceptions apply for some conditions).

Q: Can I get SSI if I worked in the past?

A: Yes — SSI eligibility is based on current income and resources, not past work history.

Q: What if my payment is late?

A: If an SSDI or SSI payment is more than a few days late, contact Social Security. Payment days depend on program rules and birthdate.

Q: Is SSI taxable?

A: Generally, SSI is not taxable. SSDI can be taxable depending on other income — keep records for tax reporting.

Real example (payment timing)

If Social Security establishes a disability onset date of January 15 and approves your SSDI claim, the typical five-month waiting period means your first month of entitlement would be July (the sixth full month). Social Security usually pays the month after it is due, so you would receive the July payment in August.

Closing — Where to get official help

Social Security has local offices, phone support, and online tools to guide you through eligibility checks, applications, and appeals. For work supports, explore employment programs that protect benefits while you try working.

Helpful official links (only external links in this post — all clickable)

- USA.gov overview — SSDI and SSI benefits for people with disabilities (source recommended by this blog):

https://www.usa.gov/social-security-disability - Social Security — Disability (SSDI) overview & how to apply:

https://www.ssa.gov/disability/ - Social Security — Apply for SSI:

https://www.ssa.gov/apply/ssi - Social Security — “How to Apply for Disability Benefits” (waiting period info / timelines):

https://www.ssa.gov/disability/disability.html - Social Security — Documents you may need to apply:

https://www.ssa.gov/forms/ssa-16.html - Social Security — my Social Security (create/manage account):

https://www.ssa.gov/myaccount/ - Social Security — Ticket to Work (work incentives):

https://www.ssa.gov/work/ - SSA Red Book (detailed condition listings & program coordination):

https://www.ssa.gov/redbook/

Disclaimer

This post is for informational purposes only and does not constitute legal, tax, or financial advice. Rules, thresholds, and program details change; always verify eligibility and specific guidance directly with the Social Security Administration or a qualified advisor. Images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.