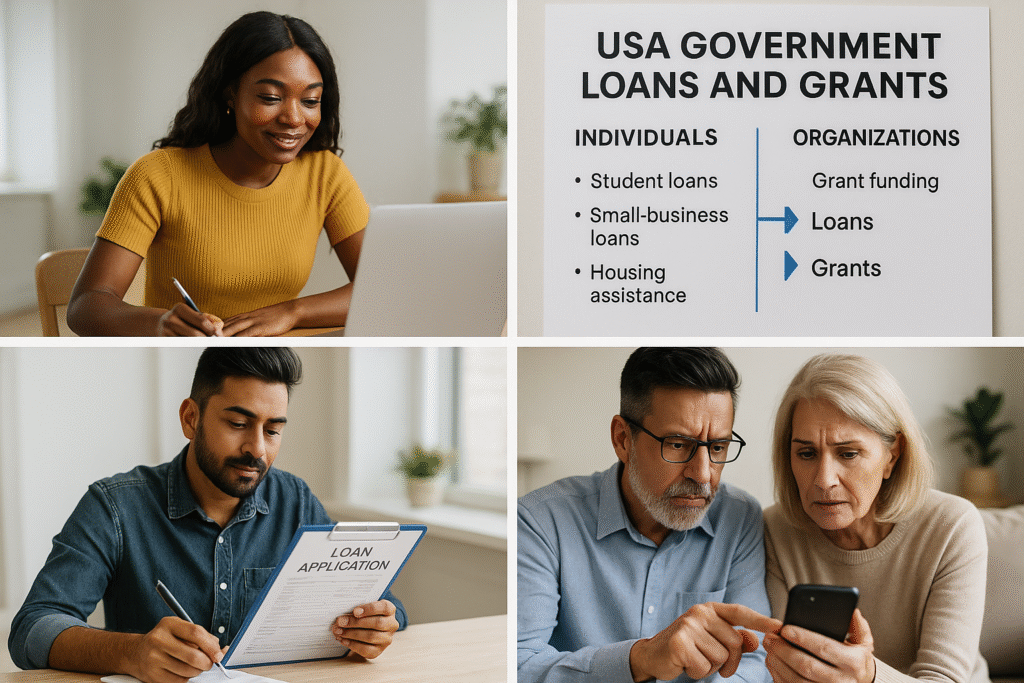

USA Government Loans and Grants Access: Government funding can be a powerful tool — whether you need a student loan, a small-business loan, help buying or repairing a home, or grant funding for an organization. This clear, step-by-step guide shows you exactly where to look, how loans and grants differ, which programs serve individuals vs. organizations, and how to apply without falling for scams.

Quick summary — who gets what

- Government loans are money you borrow and must repay (often with favorable terms). Federal loans commonly support education, homeownership, small businesses, farm operations, and disaster recovery. (USAGov, Federal Student Aid)

- Federal grants typically fund organizations, research, and public projects — not individuals’ personal expenses. If you run a nonprofit, university lab, state or local government, or an eligible business program, Grants.gov and agency sites are where to look. (Grants.gov)

- Government benefits (food, housing, medical) are not loans and usually don’t need repaying; use USA.gov’s benefit finder for personal assistance programs. (USAGov)

Why this matters: loans ≠ free money

Many people search for “free” federal money and get disappointed — or worse, scammed. In the U.S., most direct federal funding to individuals comes as loans for specific purposes (education, home, business, agriculture) or as benefits. Grants in the federal system are overwhelmingly awarded to organizations or institutions, not to pay personal living expenses. Knowing this saves time and prevents costly mistakes. (USAGov, Grants.gov)

Step 1 — Choose the right path: loan, grant, or benefit?

Ask a simple question first: Is this funding for a personal need (school, home, business) or for a project/organization?

- Personal needs → start with loan programs and benefits (student loans at Federal Student Aid, home loans via USDA/FHA, business loans via SBA). (Federal Student Aid, Small Business Administration)

- Organizational projects → search Grants.gov and specific agency grant pages. Grants.gov is the central portal for federal grant opportunities and application guidance. (Grants.gov)

- Basic living needs → check USA.gov Benefit Finder for programs like SNAP, Medicaid, and housing assistance. (USAGov)

Step 2 — Where to look (official, trusted places)

Start at the official portals — they’re free and authoritative:

- USA.gov — Government loans & grants overview: plain-language explanations and links to programs. (USAGov)

- Grants.gov — search and apply for federal grant opportunities (primarily for organizations and institutions). (Grants.gov)

- Studentaid.gov — federal student loans, grants, work-study, and FAFSA guidance. (Federal Student Aid)

- SBA.gov (Small Business Administration) — loan programs, disaster assistance, and guidance for small businesses. (Small Business Administration)

- USDA, HUD, VA, and other agency pages — housing, rural home loans/grants, veterans’ home loans, and sector-specific funding. (For example, USDA offers homeownership and home-repair loan/grant programs in rural areas.) (USDA)

Bookmark these pages and use only official .gov sites when applying.

Step 3 — Learn the eligibility rules before you apply

Each program has its own eligibility tests (income, purpose, citizenship/residency, credit, business size or type, disaster declaration status). Read program rules carefully — being well-prepared raises your chance of approval.

Quick examples:

- Federal student loans usually require FAFSA completion and enrollment in an eligible school. (Federal Student Aid)

- SBA loans require business documents and often personal credit info; disaster loans have separate timelines and documentation rules. (Small Business Administration)

- Grants.gov listings include a clear “Eligible applicants” section (nonprofits, tribal governments, universities, etc.). Make sure your organization matches before you spend time on a proposal. (Grants.gov)

Step 4 — Assemble the paperwork and apply carefully

Preparation wins. Typical items you may need:

- Government ID and Social Security numbers (individual loans).

- Tax returns, bank statements, and proof of income.

- Business plan, financial statements, and registration docs for SBA loans.

- A clear project narrative, budget, and partner letters for grants.

Use official application portals (FAFSA/StudentAid, SBA Lender Match, Grants.gov Workspace). Follow the application instructions precisely — many rejections happen from missing attachments or incorrect formats. (Grants.gov, Federal Student Aid)

Step 5 — Common programs people actually use

Here are the federal options most individuals and small organizations find useful:

- Federal student aid (loans and grants) — FAFSA is the gateway to Pell Grants, subsidized/unsubsidized loans, and work-study. (Federal Student Aid)

- SBA loan programs — 7(a), 504, microloans, and disaster loans for business owners. SBA also maintains partnerships with approved lenders. (Small Business Administration)

- USDA homeownership & repair loans/grants (rural) — assistance for low- and moderate-income rural residents. (USDA)

- Agency-specific grants — Department of Education, Health Resources & Services Administration, Department of Transportation, and others post opportunities on Grants.gov (for eligible organizations). (U.S. Department of Education, hrsa.gov)

If you’re unsure which program fits, use the USA.gov pages and agency helplines — they’ll point you to the correct application pathway. (USAGov)

Step 6 — Spot and avoid “free money” scams

Scammers prey on people seeking grants or loans. Red flags include requests for payment to get a grant, demands for your bank account or full PIN, and offers that sound too good to be true.

How to stay safe:

- Never pay to apply for a federal grant or loan through an official portal. Federal application systems are free. (Grants.gov)

- Verify contacts and URLs — official sites end with .gov (or sometimes .mil).

- For Grants.gov and other portals, use the site’s “Prevent Scams” guidance and report suspicious offers to the agency. (Grants.gov)

If someone calls claiming to be a government official and asks for money or personal financial details, hang up and call the agency’s official phone number from its website.

Step 7 — After you apply: tracking, appeals, and next steps

- Track your application in the official portal (FAFSA account, Grants.gov Workspace, SBA Lender Dashboard). (Grants.gov)

- If denied, ask for the reason and whether you can remedy the issue (for example, supply missing documents or correct an income error). Some programs offer appeals or reapplication windows.

- If approved, read the award or loan terms carefully: interest rates, repayment schedules, reporting requirements (for grants), and conditions that could trigger recapture or default.

Helpful checklist (copy/paste)

- Decide: loan, grant, or benefit?

- Visit the official portal(s): USA.gov / Grants.gov / StudentAid / SBA / relevant agency. (USAGov, Grants.gov)

- Read eligibility & collect required documents.

- Fill forms exactly as instructed and upload attachments in correct formats. (Grants.gov)

- Track your application and save all receipts/confirmation emails.

- Beware of scams — never pay to apply or give full banking credentials.

Short FAQ

Q: Can I get a federal grant to pay my personal living expenses?

A: Almost never. Most federal grants fund organizations and projects. Individuals seeking personal financial help should check benefit programs or loan options. (USAGov)

Q: Where do I apply for federal grants?

A: Grants.gov is the central portal for federal grant opportunities for organizations. Individual agencies may also host guidance and program details. (Grants.gov)

Q: Are government loans free?

A: No — loans must be repaid; however, federal loans often have lower rates or flexible repayment options compared with private lending. Read the terms carefully. (Federal Student Aid, Small Business Administration)

Final notes

Getting government funding is rarely instantaneous, but using official portals, understanding eligibility, preparing accurate documents, and avoiding scams will put you in the best position to succeed. If you’d like, I can create a printable one-page checklist or step-by-step application script tailored to student loans, SBA loans, or grants.gov applications.

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or financial advice. Program rules, deadlines, and eligibility criteria can change — always confirm details on official government websites before applying. Images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.

Helpful official links (clickable)

- How to get a government loan or grant — USA.gov. (USAGov)

https://www.usa.gov/government-loan - Government grants and loans overview — USA.gov. (USAGov)

https://www.usa.gov/government-grants-and-loans - Grants.gov — search federal grant opportunities (organizations). (Grants.gov)

https://www.grants.gov - Federal student aid (FAFSA, loans & grants) — StudentAid.gov. (Federal Student Aid)

https://studentaid.gov - Small Business Administration — funding programs & loans. (Small Business Administration)

https://www.sba.gov - How to apply for grants — Grants.gov applicant guidance. (Grants.gov)