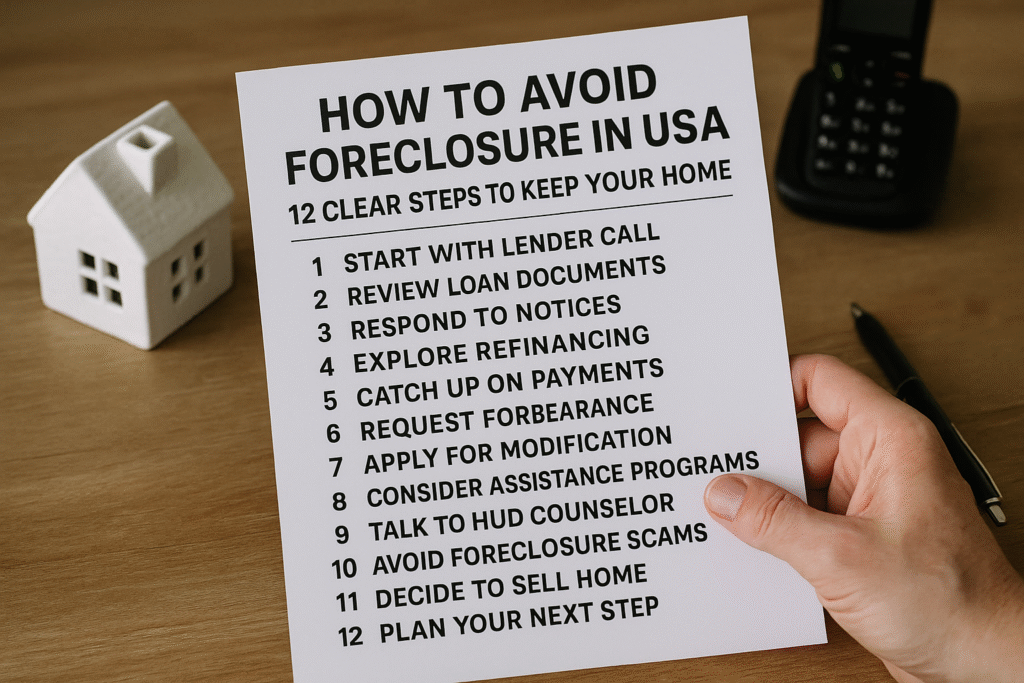

How to Avoid Foreclosure in USA: Facing missed mortgage payments or a foreclosure notice is frightening, but there are concrete steps you can take to protect your home. This practical, step-by-step guide explains what to do now, who to call, what papers to gather, which programs can help, how to spot scams, and how to move forward whether you can keep your house or must consider alternatives.

Quick summary — the first things to do

- Contact your mortgage servicer immediately. Open communication is the single most important action.

- Get a HUD-approved housing counselor. Counselors provide free, practical help and can negotiate with your servicer.

- Check your state Homeowner Assistance Fund (HAF). If available in your state, HAF can often pay arrears directly and stop a foreclosure.

- Avoid scams. Never pay an upfront fee for a guaranteed foreclosure solution.

- If a foreclosure lawsuit arrives, act now. Missing deadlines can eliminate your options.

Read on for detailed actions, scripts, and a final checklist you can use immediately.

1. Call your mortgage servicer the moment you know you’ll miss a payment

Don’t wait for the lender to start foreclosure paperwork. Call the phone number on your mortgage statement, explain the hardship, and ask about options such as forbearance, repayment plans, or loan modification. Write down the representative’s name, date, time, and any promises they make. Documentation of these conversations can be crucial.

2. Contact a HUD-approved housing counselor right away

HUD-approved counselors offer free, confidential advice tailored to your situation. They can review loss mitigation options, help organize documents, contact your servicer with you, and guide you through applications for assistance programs. Counseling is often the fastest route to a workable plan.

3. See whether your state’s Homeowner Assistance Fund (HAF) can help

Many states received federal HAF dollars to assist homeowners impacted by the pandemic; some programs or successor funds still operate locally. HAF funds can pay past-due mortgage amounts, property taxes, homeowner’s insurance, and other qualified costs—often directly to the servicer. If your state program is active, applying quickly can halt a pending sale.

4. Know the most common lender options and what they mean

- Forbearance: Temporarily reduce or suspend payments. You still owe the missed amounts later, but it stops foreclosure while you recover.

- Repayment plan: Spread past-due amounts across future payments.

- Loan modification: Permanently change loan terms (rate, term, principal) to make payments affordable.

- Short sale or deed in lieu: If keeping the house isn’t feasible, these can be alternatives that may be less damaging than a completed foreclosure.

Which option fits depends on your loan type, arrears size, and income — your counselor and servicer can explain the best path.

5. Organize the documents lenders and programs will ask for

Prepare digital scans or paper copies of:

- Mortgage statement and account number

- Recent pay stubs or other income proof (last 30–90 days)

- Bank statements (last 2–3 months)

- A one-page hardship letter explaining the cause (job loss, medical bills, reduced hours)

- Homeowner’s insurance and property tax records (if relevant)

Having organized documents speeds review and prevents delays that can worsen the situation.

6. Watch out for scams — never pay upfront for promised results

Scammers commonly advertise guaranteed foreclosure relief for an advance fee. Legitimate HUD-approved counselors and legal aid are free. If a company asks for substantial money up front, claims to “guarantee” you’ll keep the house, or tells you not to talk to your lender, stop and verify. Report scams to your state attorney general and the Federal Trade Commission.

7. If your loan is FHA-insured, contact FHA assistance resources

If you have an FHA loan, the FHA National Servicing Center can point out FHA-specific loss mitigation options. Servicers handling FHA loans must follow certain FHA rules; early contact can surface options you might otherwise miss.

8. Get legal help if a foreclosure complaint is filed or if your servicer won’t cooperate

A foreclosure lawsuit brings strict deadlines. If you receive a complaint or summons, don’t ignore it — failing to respond often leads to default judgment. Contact local legal aid or a housing attorney immediately. Many states offer free or low-cost foreclosure defense programs for qualifying homeowners.

9. Consider realistic alternatives if keeping the home is no longer possible

If loss mitigation fails, consider:

- Short sale: With lender approval, sell the property for less than the mortgage balance.

- Deed in lieu of foreclosure: Voluntarily transfer the deed to the lender to avoid formal foreclosure.

Both options have consequences but can be less harmful to future housing prospects and credit than a foreclosure sale.

10. Be proactive — track all deadlines, court dates, and paperwork

Create a simple timeline that includes missed payment dates, dates you contacted the servicer, application submission dates, and all court deadlines. Missing a court or paperwork deadline can close off options. Always keep copies and confirm receipt of important documents by email or certified mail when possible.

11. Use both federal and local resources — local programs sometimes act faster

In addition to HUD and HAF, local nonprofits, state housing finance agencies, and community action agencies often run emergency funds or successor programs. Ask your HUD counselor to point you to open local resources. Combining federal guidance with locally administered programs is often the fastest route to stop an imminent sale.

12. Final checklist — immediate actions to take now

- Call your mortgage servicer and document the conversation.

- Contact a HUD-approved housing counselor for free help.

- Check your state Homeowner Assistance Fund and apply if you qualify.

- Gather required documents (mortgage account info, pay stubs, bank statements, hardship letter).

- If you get a foreclosure lawsuit, contact legal aid immediately and file a response by the court deadline.

- Avoid upfront fees and guarantee claims—report suspected scams.

- If keeping the home isn’t feasible, ask about short sale or deed in lieu as less-damaging exit options.

Helpful official resources (click to verify or act)

- USA.gov — How to avoid foreclosure:

https://www.usa.gov/avoid-foreclosure - HUD — Avoiding Foreclosure & HUD-approved housing counselors (call 1-800-569-4287):

https://www.hud.gov/helping-americans/avoiding-foreclosure - U.S. Treasury — Homeowner Assistance Fund (state map and program pages):

https://home.treasury.gov/policy-issues/coronavirus/assistance-for-state-local-and-tribal-governments/homeowner-assistance-fund - Consumer Financial Protection Bureau — Help for homeowners and how to avoid foreclosure scams:

https://www.consumerfinance.gov/housing/housing-insecurity/help-for-homeowners/avoid-foreclosure/ - FHA National Servicing Center (for FHA-insured loans):

https://www.hud.gov/hud-partners/single-family-national-service-center (phone: 1-877-622-8525) - Legal Services Locator — find free or low-cost legal aid near you:

https://www.lsc.gov/what-legal-aid/find-legal-aid

Closing note

Disclaimer: This guide is for informational purposes only and not legal, financial, or tax advice. Laws, programs, and assistance availability change; always verify options with HUD-approved housing counselors, your mortgage servicer, or a qualified attorney before you act. All images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.