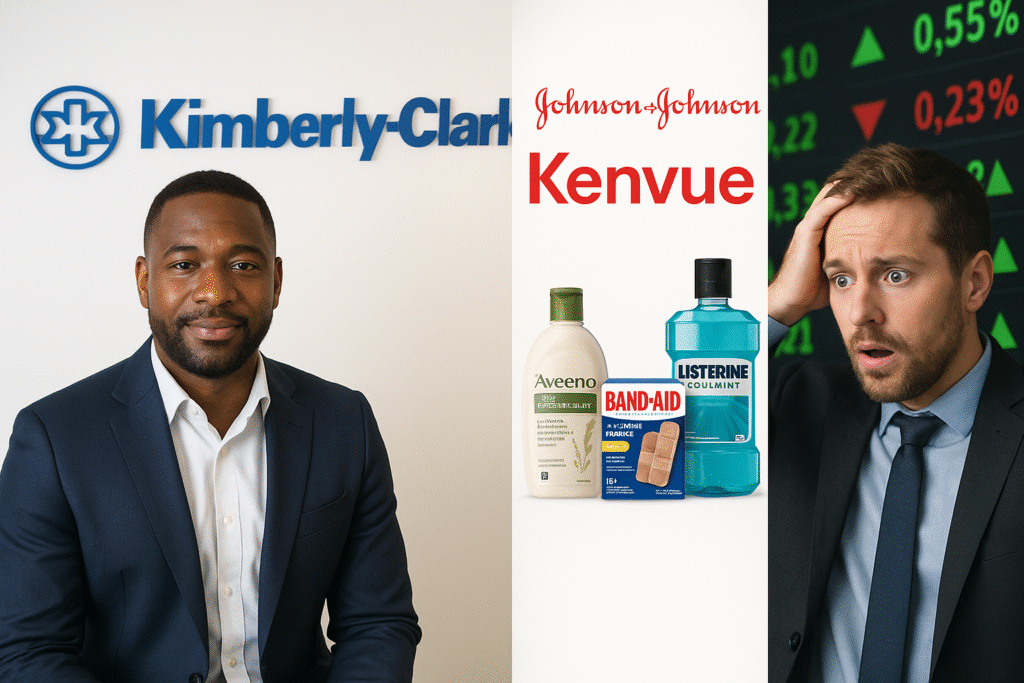

Kimberly Clark Kenvue Deal: Kimberly-Clark (ticker KMB) announced a landmark acquisition of Kenvue (ticker KVUE), the company that owns Tylenol, Aveeno, Band-Aid and other consumer-health staples.

This post explains the deal, the market reaction, why it matters for shareholders and consumers.

TL;DR — the short headline

Kimberly-Clark will acquire Kenvue in a cash-and-stock transaction valuing Kenvue at roughly $48.7 billion; Kimberly-Clark shareholders will own about 54% of the combined company and Kenvue shareholders 46%. The deal aims to create a roughly $32 billion consumer health giant with targeted cost synergies. Market reaction was swift: KMB shares fell on the announcement while KVUE shares jumped.

1) What exactly did Kimberly-Clark and Kenvue announce?

The companies announced a definitive agreement: Kimberly-Clark will buy Kenvue in a mixture of cash and stock, at an enterprise valuation near $48.7 billion.

Managements say the combined company would capture scale across baby care, wound care, OTC medicines (Tylenol), and household essentials. The press release describes expected cost savings and cross-brand opportunities.

Why it’s load-bearing: this is one of the largest consumer-health tie-ups in recent years and bundles many of the world’s most recognized household brands under one roof.

2) How will the ownership and economics work?

Under the announced terms, Kimberly-Clark shareholders will own a controlling stake (~54%) in the combined business; Kenvue shareholders will retain about 46%.

The deal includes a fixed per-share cash component for Kenvue holders, with reports noting the math used to arrive at the deal price was tied to Kimberly-Clark’s closing price. Barron’s and other outlets reported the per-share cash figure derived from the agreed exchange ratio.

This structure aims to preserve Kimberly-Clark’s control while offering Kenvue holders immediate cash value plus upside as part owners of the combined company.

3) Why now? The strategic rationale behind the Kimberly-Clark Kenvue deal

Kenvue has faced operational pressures, activist investor scrutiny and recent leadership changes as it pursues profitability improvements.

Kimberly-Clark, long focused on paper and personal-care staples (Kleenex, Huggies, Cottonelle), gets an expanded OTC & skincare portfolio (Tylenol, Neutrogena/Aveeno in some regions through previous ties), creating cross-sell and distribution opportunities. Management cited expected $1.9 billion in cost synergies within three years.

Put simply: scale, supply-chain leverage and distribution breadth are the stated strategic drivers.

4) Market reaction — what happened to KMB and KVUE shares

On the announcement, Kimberly-Clark shares fell sharply (market reports noted ~15% intraday declines), while Kenvue shares jumped (reported ~20% rise premarket).

That pattern is common when an acquirer pays a premium: the target rises toward the deal value and the acquirer often dips on investor worries about price, integration risk, or financing.

For income investors who hold KMB for its dividend history (Kimberly-Clark has a multi-decade streak of dividend increases), the dip raises questions about near-term dividend policy and balance-sheet plans. Kimberly-Clark’s management signaled intent to preserve long-term shareholder value.

5) What about Tylenol — who actually owns it now?

Kenvue — spun out of Johnson & Johnson — owns the Tylenol brand. With the Kimberly-Clark Kenvue deal, Tylenol becomes part of the combined consumer health portfolio under the new ownership structure.

The transaction brings OTC medicines (Tylenol and others) into closer alignment with everyday consumer brands like Kleenex and Huggies, which could reshape marketing and distribution playbooks globally.

Note: Tylenol has faced public scrutiny and legal/regulatory attention in 2025; combining the brands changes who manages reputation and litigation responses going forward.

6) Will Kimberly-Clark change its dividend / capital allocation because of the deal?

Investors watching KMB often cite its long dividend increase streak (50+ years). The company historically has a strong dividend policy, but large acquisitions can affect payout plans, leverage targets and buybacks.

Kimberly-Clark’s filings and recent earnings commentary (Q3 2025) show robust cash flows, but the size of this deal means management will balance debt, integration costs and shareholder returns — expect investor calls and proxy materials to clarify specifics.

If protecting the dividend is a priority, watch the company’s guidance and the financing plan the board releases in the coming months.

7) Regulatory, litigation and integration risks to watch

Large consumer-health mergers draw antitrust and regulatory attention, especially when a deal combines major market players across many product categories.

Kenvue also faced management turnover and portfolio reviews earlier in 2025, which means liabilities and litigation exposure (in some markets) will be a key part of due diligence and shareholder voting. Regulators will review overlap in categories and distribution; the companies say they’re prepared to work with authorities.

Practical investor tip: read the definitive proxy and regulatory filings — they list contingent liabilities, litigation reserves and proposed remedies. Those documents determine the transaction’s real value, not just the headline price.

8) What this means for everyday consumers and brand portfolios

From a shopper’s perspective, you’re unlikely to see immediate product changes. The combined firm will own many trusted daily brands across baby care, paper goods, wound care and OTC medicines.

Longer term, expect tighter global distribution, possible product bundling, and strategic marketing that leverages the combined company’s scale. For some markets the deal could accelerate innovation and product-bundle promotions; in others, regulators might require divestitures.

If you use Tylenol, Kleenex or Huggies, the practical short-term takeaway is continuity — product availability and labeling generally continue unchanged during integration.

9) What about CIFR (you asked) — is it related?

Short answer: no — CIFR (Cipher Mining Inc., ticker CIFR) is a publicly traded crypto-mining company and has nothing to do with Kimberly-Clark or Kenvue’s consumer-health businesses.

CIFR’s price moves and fundamentals follow the cryptocurrency and data-center cycles rather than consumer-health mergers. If you track CIFR, use crypto-mining and energy-cost metrics, not consumer-brand news, to evaluate it.

Why I include this: you asked about multiple tickers/terms — it’s important to separate unrelated stories so readers/investors don’t conflate a consumer-health megamerger with a mining company’s stock action.

Quick investor checklist — what to watch next

- Definitive documents & proxy materials — these reveal the exact exchange ratio, cash components and any collar or termination fees.

- Financing plan & credit ratings — big deals can change leverage and borrowing costs.

- Regulatory filings — timeline for antitrust reviews and any required divestitures.

- Shareholder votes — Kenvue shareholder approval will be required; watch schedule and vote outcomes.

- Earnings-call commentary — management’s remarks on synergy realization, dividend intent, and integration costs.

Final take — is this good for KMB shareholders and consumers?

The Kimberly-Clark Kenvue deal is strategically bold: it creates a scale-heavy consumer health champion that could command broad shelf & online presence.

But size brings complexity: integration risks, regulatory review, litigation liabilities and balance-sheet pressures matter. Short-term market moves (KMB down, KVUE up) reflect those tradeoffs. Long-term outcomes will depend on disciplined execution and clear capital-allocation choices.

If you’re an investor, treat the news as the start of a multi-month story: read the SEC filings, listen to management’s calls, and reassess allocation in light of your income and risk needs. If you’re a consumer, expect continuity for now — but watch brand portfolios and product announcements over the next 12–24 months.

Disclaimer: This article summarizes public reporting and company announcements as of November 3, 2025. It is for informational purposes only and is not investment advice. Consult a licensed financial advisor before making any investment decisions.

Verified external links

- Reuters — Kimberly-Clark to acquire Tylenol maker Kenvue in $48.7 billion deal. (Reuters)

https://www.reuters.com/business/healthcare-pharmaceuticals/kimberly-clark-acquire-kenvue-487-billion-deal-2025-11-03/ - AP / CBS News — Tylenol, Kleenex, Band-Aid and more put under one roof in $48.7 billion consumer brands deal. (AP News)

https://apnews.com/article/98d5fd39c12b25524e3188da2e840436 - Kimberly-Clark / Kenvue joint press release (PR Newswire) — Kimberly-Clark to Acquire Kenvue, Creating a $32 Billion Global Health and Wellness Leader. (PR Newswire)

https://www.prnewswire.com/news-releases/kimberly-clark-to-acquire-kenvue-creating-a-32-billion-global-health-and-wellness-leader-302602379.html - Kenvue Investor Relations — stock info for KVUE. (investors.kenvue.com)

https://investors.kenvue.com/stock-info/default.aspx - Cipher Mining (CIFR) — stock quote & profile (example resource for CIFR inquiries). (Yahoo Finance)

https://finance.yahoo.com/quote/CIFR/