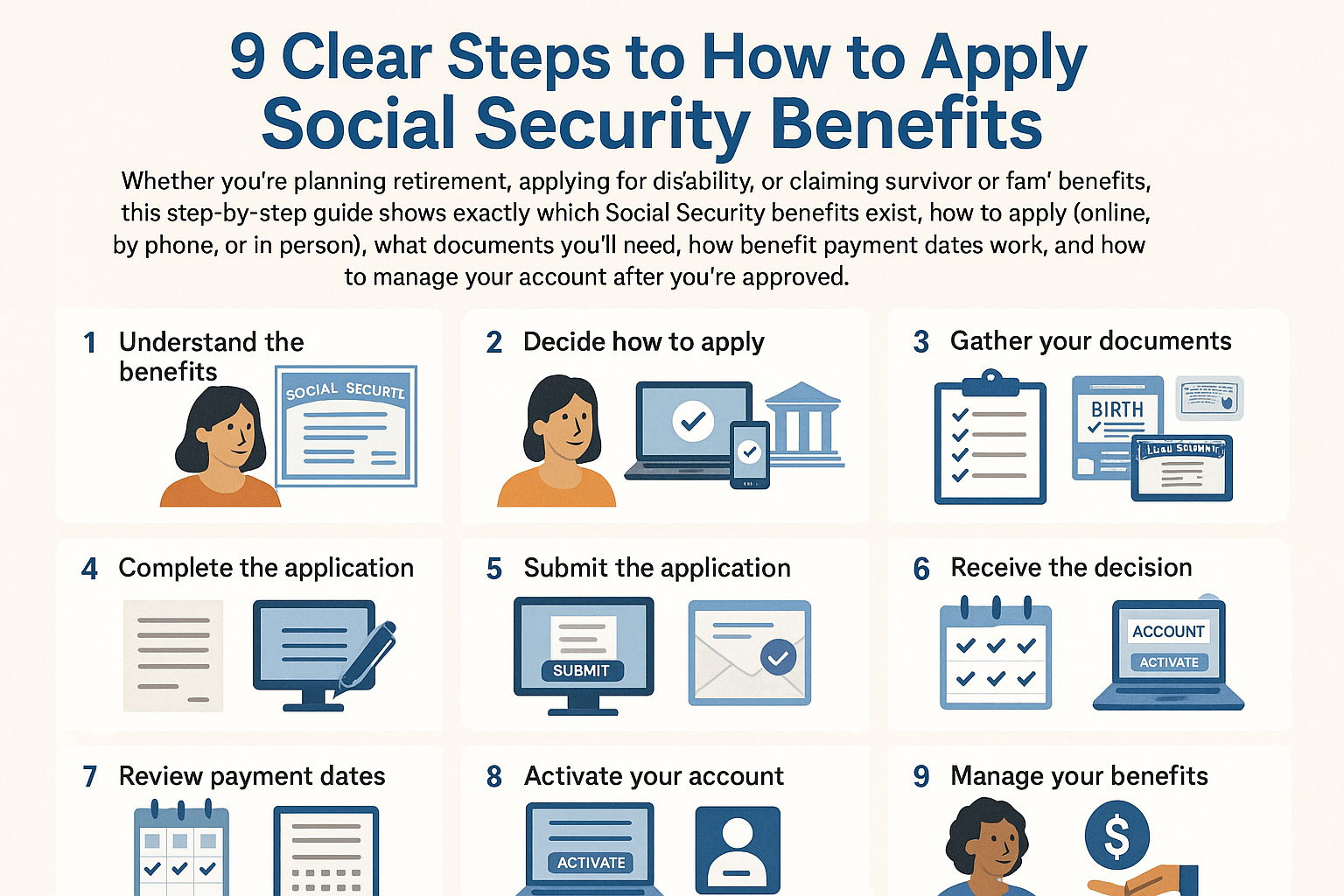

How to Apply Social Security Benefits: Whether you’re planning retirement, applying for disability, or claiming survivor or family benefits, this step-by-step guide shows exactly which Social Security benefits exist, how to apply (online, by phone, or in person), what documents you’ll need, how benefit payment dates work, and how to manage your account after you’re approved.

Why this matters right now

Social Security is the foundation of retirement and disability income for millions. Knowing which benefit fits your situation, how to apply efficiently, and how to keep your information up to date (so payments arrive on time) can save weeks of delay and give you peace of mind.

The four main Social Security benefits (what they are)

- Retirement benefits — monthly payments based on your earnings record; the amount depends on when you claim (age 62 to 70 affects the monthly amount).

- Social Security Disability Insurance (SSDI) — for workers (and in some cases certain family members) who have earned enough Social Security credits and can’t work because of a qualifying disability.

- Supplemental Security Income (SSI) — needs-based federal cash assistance for people who are aged, blind, or disabled and have limited income/resources (different rules from SSDI).

- Family & survivor benefits — payments for spouses, ex-spouses, children, and survivors when a worker who paid Social Security taxes dies.

(If you get SSDI, your benefits generally convert automatically to retirement benefits when you reach full retirement age — the dollar amount stays consistent.)

Quick decision map: which benefit should you apply for?

- Near retirement and work history is solid → Retirement benefits.

- Under retirement age and medically unable to work for 12+ months → SSDI.

- Low income/resources and qualifying age or disability → SSI.

- You lost a spouse or a worker in your family → Survivor benefits.

If you’re unsure, start at the online SSA “Apply” guidance or call SSA for a short screening—many people begin with the online application checklist.

9 practical steps to apply (do these in order)

Step 1 — Prepare (documents to gather; 30–90 minutes)

Common documents you’ll need:

- Your Social Security number and birth certificate (or acceptable proof of age).

- U.S. citizenship or lawful-alien status documents (if applicable).

- Recent W-2s or self-employment tax records; pay stubs if you recently worked.

- Proof of medical condition (for SSDI) — doctors’ reports, test results, treatment history.

- Bank routing & account numbers for direct deposit.

Scan or photograph everything so you can upload them if you apply online. (SSA lists exact document requirements by application type)

Step 2 — Apply online when possible (fastest, usually)

The Social Security Administration lets you apply for retirement, SSDI (in many cases), SSI (sometimes by appointment), and other benefits online — the SSA online portal walks you through each application and lets you save and return to a partially completed form. Online filing is typically the fastest route.

Step 3 — If you can’t apply online, call or visit (alternatives)

If online filing isn’t possible (complex cases, lack of documents, or SSI for some applicants), call SSA at 1-800-772-1213 (business hours vary) to schedule an appointment or visit your local Social Security office. For disability claims, you can also start by scheduling by phone.

Step 4 — Complete any additional steps SSA requests

SSA may ask for more medical records, employment history, or proof of identity. Respond quickly to requests (they’ll list a deadline) — missing documents are the most common cause of delay. For SSDI, good medical documentation is especially important.

Step 5 — Track your application and appeals process

Use your my Social Security account to check application status, see messages, and print benefit verification letters. If your claim is denied, you have the right to appeal — SSA explains timelines and how to request reconsideration, hearings, or further review.

Step 6 — Set up direct deposit (recommended)

SSA strongly encourages electronic payments. You can set up or change direct deposit through your my Social Security account or by following SSA’s direct-deposit instructions; doing this prevents mailed check delays. If your payment is more than three days late after the scheduled payment date, contact SSA.

Step 7 — Know when monthly payments are made

SSA pays benefits monthly. In general, benefits are scheduled by birth date (for 1997 and later eligibles): people born on the 1st–10th are paid the second Wednesday each month; 11th–20th paid the third Wednesday; 21st–31st paid the fourth Wednesday. Special rules apply if you started receiving benefits before May 1997 or if you also receive SSI. If you don’t get a payment when expected, allow three mailing days for checks before contacting SSA.

Step 8 — Keep your records current

Use your my Social Security account to update address, phone, and direct deposit. Reporting changes (address, marital status, earned income, change in medical condition for disability beneficiaries) quickly helps avoid overpayments or missed notices. Some changes (like direct-deposit changes) may require additional identity verification or an in-person step.

Step 9 — Get help if you’re stuck

If the process is confusing or you need in-person help, call SSA, visit a local office, or contact a qualified benefits counselor (for example, a State Health Insurance Assistance Program (SHIP) counselor for retirement timing questions). Community legal aid or disability advocates can help with SSDI appeals.

Timing & realistic expectations

- Retirement claims processed quickly online and payments usually begin the month after your application is approved (timing depends on the start month you choose).

- SSDI decisions often take longer — medical reviews, consultative exams, or appeals can extend processing to months. Prepare for an extended timeline and keep careful medical records.

Short FAQ (quick answers)

Q: What age should I claim retirement benefits?

A: The earlier you claim (as early as 62) the lower your monthly benefit; delaying up to age 70 increases your monthly benefit. Consider your health, finances, and whether you’ll keep working. SSA has calculators and planners.

Q: How do I check if SSA received my application or change?

A: Sign in to your my Social Security account to view application status, messages, and benefit verification letters.

Q: My payment is late — what should I do?

A: Allow three mailing days if you receive paper checks; otherwise contact SSA to report a missing payment. Direct deposit issues may require contacting your bank and SSA.

Printable one-page checklist (ready to use)

- Decide which benefit to apply for (Retirement / SSDI / SSI / Survivor).

- Gather documents: birth proof, SSN, W-2s/tax records, medical records (if SSDI), ID, bank routing.

- Apply online at SSA’s apply pages (fastest) or call 1-800-772-1213 to schedule. (

- Upload/send requested supporting documents promptly.

- Create a my Social Security account to track status and manage payments.

- Set up direct deposit or verify bank details in your account.

- Save all SSA letters, benefit verification, and appeal deadlines.

Disclaimer

This post is informational only and not legal, tax, or financial advice. Social Security rules, benefit formulas, and procedures change over time. Always confirm details and submit applications through official Social Security Administration pages or by contacting SSA directly. The key official resources used to verify this post are listed below. Images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.(USAGov, Social Security)

Helpful official links (click to apply or get official help)

- Social Security on USA.gov — Social Security benefits and how to apply: https://www.usa.gov/what-is-social-security. (USAGov)

- SSA — Apply online for Social Security benefits (retirement, disability, survivors): https://www.ssa.gov/apply. (Social Security)

- SSA — Schedule of Social Security Benefit Payments (payment calendar & rules): https://www.ssa.gov/pubs/EN-05-10031-2025.pdf. (Social Security)

- my Social Security — create or sign in to manage your benefits online: https://www.ssa.gov/myaccount/. (Social Security)

- SSA — Update or start direct deposit and related instructions: https://www.ssa.gov/manage-benefits/update-direct-deposit. (Social Security)