Home repairs can pile up quickly — from a leaking roof to an outdated heating system — and for many households the cost is a real barrier. Fortunately, several federal programs (plus state and local options) can help homeowners and certain special groups pay for repairs, perform critical safety upgrades, or borrow affordably to rebuild. This guide explains exactly how to get home repair assistance from government sources, who qualifies, what each major program covers, how to apply, required documents, red flags to avoid, and where to get free counseling.

Quick promise: Read this guide and you’ll know the best program(s) for your situation and the next three actions to take today.

At a glance — the main government options you should know

- HUD Title I Property Improvement Loans — insured loans for home improvements via participating lenders.

- FHA 203(k) Rehabilitation Mortgage — finance home purchase/refinance plus rehab costs in a single FHA loan.

- USDA Single-Family Housing Repair Loans & Grants (Section 504) — low-interest loans and grants for very-low-income rural homeowners (grants for seniors).

- Home Equity Conversion Mortgage (HECM) — HUD-insured reverse mortgage for homeowners 62+ that can be used for repairs (after counseling).

- VA Disability Housing Grants — housing adaptation grants for veterans with qualifying service-connected disabilities.

- State and local repair or weatherization programs — many cities and states run emergency repair funds, energy efficiency grants, and low-interest rehab loans.

Start by checking the federal landing page for repair programs and the specific program pages listed in the Resources section below. (USAGov, HUD, Rural Development, Veterans Affairs)

Who typically qualifies (and who to prioritize)

Eligibility rules vary widely, but these groups commonly qualify for government home repair help:

- Low- and very-low-income homeowners (income limits vary by county/metro area).

- Seniors (age 62+) — often eligible for grants/assistance targeted to older adults.

- Rural homeowners — USDA Section 504 serves eligible rural properties.

- Veterans with service-connected disabilities — VA offers adaptation grants for ramps, widened doorways, etc.

- Buyers planning major rehab — FHA 203(k) is designed for purchasing and repairing older homes.

If you’re unsure which bucket fits, a HUD-approved housing counselor or USDA local office can quickly point you to the right program. HUD maintains a housing counselor locator and USDA lists local offices for repair loans. (HUD Exchange, Rural Development)

How each major program works — quick, practical summaries

HUD Title I Property Improvement Loans

Title I insures lenders who make property improvement loans for homeowners. Loans are used to modernize, improve, or otherwise increase livability. You borrow from an approved lender, not from HUD directly; HUD provides the insurance that makes private lenders comfortable issuing smaller rehab loans. Check local participating lenders and program rules before applying. (HUD)

FHA 203(k) Rehabilitation Mortgage

The 203(k) loan is an FHA product that bundles purchase/refinance and remodeling costs into one mortgage. It’s ideal when a home needs structural repairs or major upgrades, and funds are placed in escrow and released as work is completed. There are two 203(k) options — Standard (for major rehab) and Limited (for smaller projects). Work must be done by approved contractors and follow HUD requirements. (HUD)

USDA Section 504 Repair Loans & Grants

If you own and live in a rural property and meet very-low-income limits, USDA Section 504 offers low-interest loans (and grants for age-62+ homeowners) to remove health/safety hazards, modernize the home, or make it accessible. Contact your local USDA Rural Development office to pre-qualify and get application forms. (Rural Development)

Home Equity Conversion Mortgage (HECM) — for seniors

Homeowners 62 and older may consider a HECM (reverse mortgage) to access home equity for repairs, but only after HUD-approved counseling and careful cost comparison. Reverse mortgages remove monthly mortgage payments but carry fees and risks; a HUD counselor will walk you through alternatives and obligations. Use HECM only if it truly fits your long-term plans. (HUD, Consumer Financial Protection Bureau)

VA Disability Housing Grants

Veterans with qualifying service-connected disabilities can apply for Specially Adapted Housing (SAH) or Special Home Adaptation (SHA) grants to modify a home (e.g., ramps, accessible bathrooms). These grants can sometimes be used to adapt an owned home for independent living. Apply through VA regional offices or via the VA housing assistance pages. (Veterans Affairs)

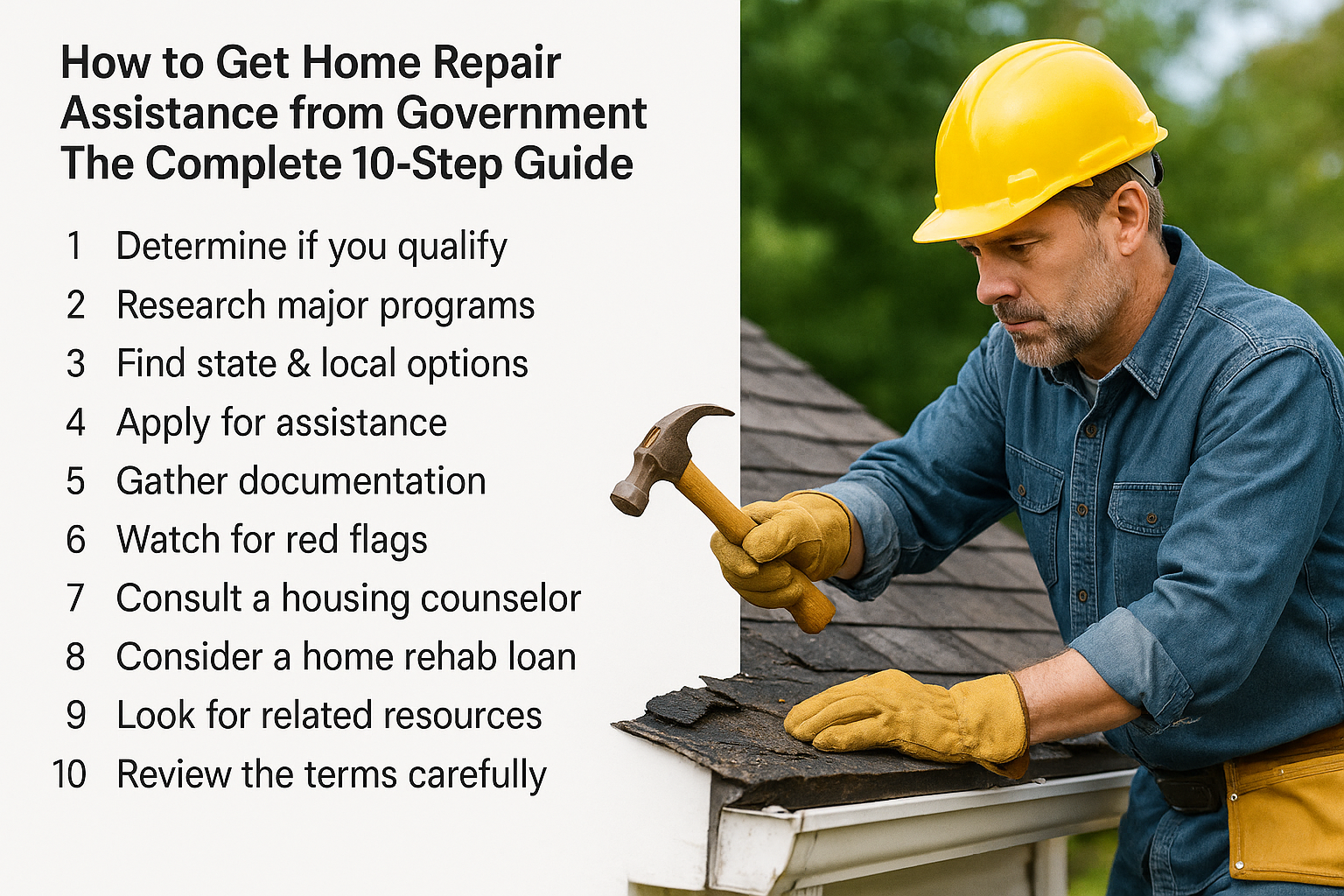

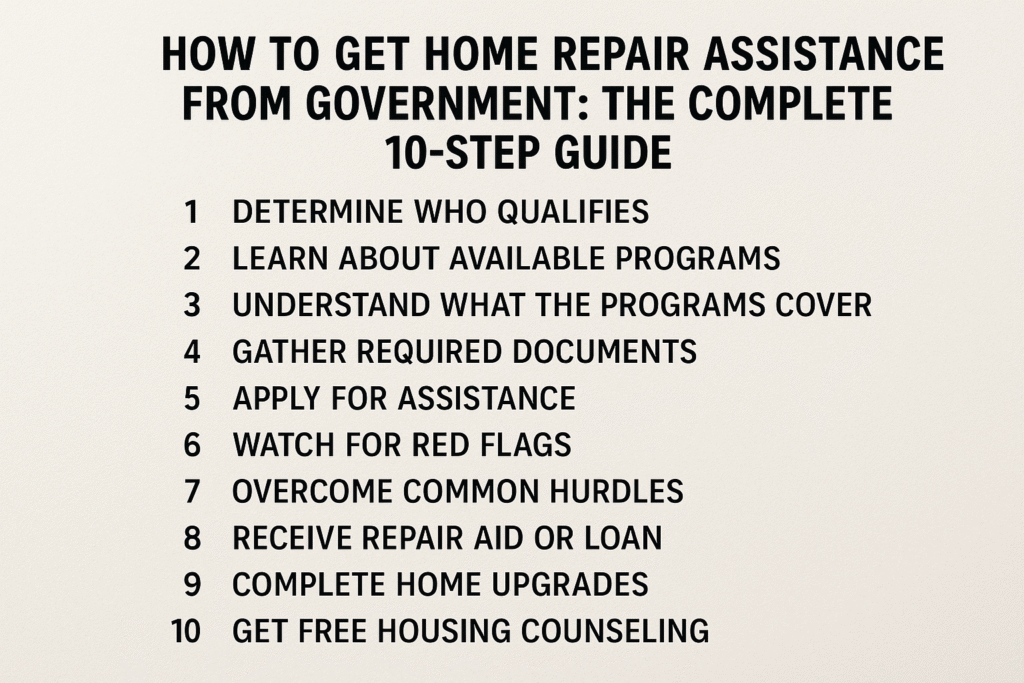

Step-by-step: How to get started (10 actions you can do this week)

- Define your need. Is it emergency (roof leak, failing furnace), accessibility (ramps, widened doors), energy (insulation, furnace upgrade), or major rehab (structural/roof/insulation)? The right program depends on the need.

- Gather basic documents. Photo ID, proof of ownership, recent pay stubs or benefit statements, recent tax return, and photos of damage/area needing repair. Having these ready speeds applications.

- Check federal landing pages first. The USA.gov home repair page lists federal options and special-group programs for veterans, Native Americans, and rural homeowners. Start there to avoid scams and get official links. (USAGov)

- Contact a HUD-approved housing counselor or USDA/VA local office. These advisers are free and can steer you to the right program and local contacts. HUD and the Consumer Financial Protection Bureau both list counselor locators. (HUD Exchange, Consumer Financial Protection Bureau)

- If rural and low income, call your USDA Rural Development office. Ask about Section 504 loans/grants and get the local intake forms. (Rural Development)

- If you’re 62+, request HUD HECM counseling before considering a reverse mortgage. Counselors explain costs, timeline, and alternatives. Don’t sign reverse mortgage documents without counseling. (HUD, Consumer Financial Protection Bureau)

- If you’re a veteran with mobility needs, check VA housing grants. Collect your DD-214 and medical evidence and contact your regional VA office for the grant application packet. (Veterans Affairs)

- For purchase + rehab, talk to FHA-approved 203(k) lenders. They can pre-qualify you and explain contractor requirements and allowable repairs. (HUD)

- Get multiple contractor bids and check credentials. For any program that requires licensed contractors, get at least two bids and verify licenses, insurance, and references. HUD warns about deceptive contractors — keep all contracts in writing. (HUD)

- Apply, follow up, and keep records. Submit applications promptly, track confirmation numbers, and respond to document requests quickly. Program staff often have limited funding and timeliness matters.

What documents programs usually ask for

- Proof of homeownership (deed, mortgage statement)

- Photo ID for adults in the household

- Social Security numbers or immigration documents (if required)

- Proof of income: pay stubs, Social Security/SSI/SSDI award letters, unemployment, or tax returns

- Cost estimates or contractor bids (for loan or rehab programs)

- Proof of veteran status for VA grants (DD-214)

Keep scanned copies in cloud storage or on your phone for quick upload.

Red flags & scam warnings — protect yourself

- No upfront fees: legitimate government programs and HUD-approved counselors do not require large upfront payments to process an application.

- Beware of unsolicited contractor knockers: don’t sign on the spot; verify licensure and obtain written estimates.

- Reverse mortgage caution: reverse mortgages are complex — always complete HUD counseling and review alternatives. Consumer Financial Protection Bureau guidance is a must-read before choosing HECM. (Consumer Financial Protection Bureau, Consumer Financial Protection Bureau)

Quick checklist — three things to do now

- Visit the official home repair landing page and pick the most likely program for you. (Start: https://www.usa.gov/home-repair-programs) (USAGov)

- Call a HUD counselor or your local USDA/VA office to request prequalification guidance. (HUD Exchange, Rural Development, Veterans Affairs)

- Collect ID, proof of ownership, income docs, and three contractor bids (if possible).

Official resources — click to start your application or get free help

- USA.gov — Government home repair assistance programs: https://www.usa.gov/home-repair-programs. (USAGov)

- HUD — Title I Property Improvement Loans: https://www.hud.gov/hud-partners/single-family-title. (HUD)

- HUD — FHA 203(k) Rehabilitation Mortgage: https://www.hud.gov/hud-partners/single-family-203k. (HUD)

- USDA — Single-Family Housing Repair Loans & Grants (Section 504): https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-repair-loans-grants. (Rural Development)

- HUD — HECM reverse mortgage counseling and resources: https://www.hud.gov/hud-partners/single-family-hecmhome. (HUD)

- VA — Disability housing grants (SAH & SHA): https://www.va.gov/housing-assistance/disability-housing-grants/. (Veterans Affairs)

- CFPB — Reverse mortgage consumer resources: https://www.consumerfinance.gov/consumer-tools/reverse-mortgages/. (Consumer Financial Protection Bureau)

- Find a HUD-approved housing counselor: https://www.hudexchange.info/programs/housing-counseling/find-a-housing-counselor/. (HUD Exchange)

Final word

“How to get home repair assistance from Government” is a question with many correct answers — the best one depends on your age, income, location, and the type of repairs you need. Start with the official links and a HUD-approved counselor; they’ll save you time and help avoid scams.

Disclaimer: This post is informational and not legal, tax, or financial advice. Program rules, income thresholds, and fund availability change — verify requirements and application steps on the official program pages listed above before you apply. All images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.