TrumpRx, Pfizer and Drug-Price Deal: Pharmacy headlines moved fast on September 30, 2025: President Donald Trump announced a high-profile agreement with Pfizer and rolled out a new consumer portal called TrumpRx, promising big discounts on many prescription medicines. Pfizer issued a press release confirming a “landmark agreement” with the U.S. government, and markets reacted — PFE stock jumped on the news. But the deal raises complex policy and legal questions: what prices are really changing, how Medicaid is affected, and whether the savings will reach ordinary patients. Below is a clear, step-by-step guide to the facts, the claims, and what readers should watch next.

1) Quick answer — what is TrumpRx?

TrumpRx (announced Sept. 30, 2025) is the administration’s branded portal and package of actions meant to deliver discounted prescription drugs directly to consumers and align some U.S. drug prices with those paid by comparable developed countries. The White House fact sheet describes the initiative as part of a broader “Most-Favored-Nation” executive-order strategy to tie U.S. prices to international benchmarks. The portal — TrumpRx.gov — was presented as a place where Americans could buy certain discounted medications directly.

2) What did Pfizer and the White House announce — the deal in plain language

The headline elements of the Pfizer–White House announcement:

- Pfizer agreed to offer many medicines at lower prices on the TrumpRx platform and pledged that Medicaid would get “most-favored-nation” (MFN)–style prices on the catalog of drugs covered by the agreement.

- Pfizer committed to invest tens of billions ($70 billion) into U.S. research, development and manufacturing as part of the arrangement, per administration sources and Pfizer’s statement.

- The administration offered regulatory incentives — including expedited review pathways — to encourage pharmaceutical participation.

Pfizer framed the move as a “landmark agreement” with the government to lower prices for American patients. The White House characterized the deal as a major policy win in its campaign to bring U.S. drug prices closer to international levels.

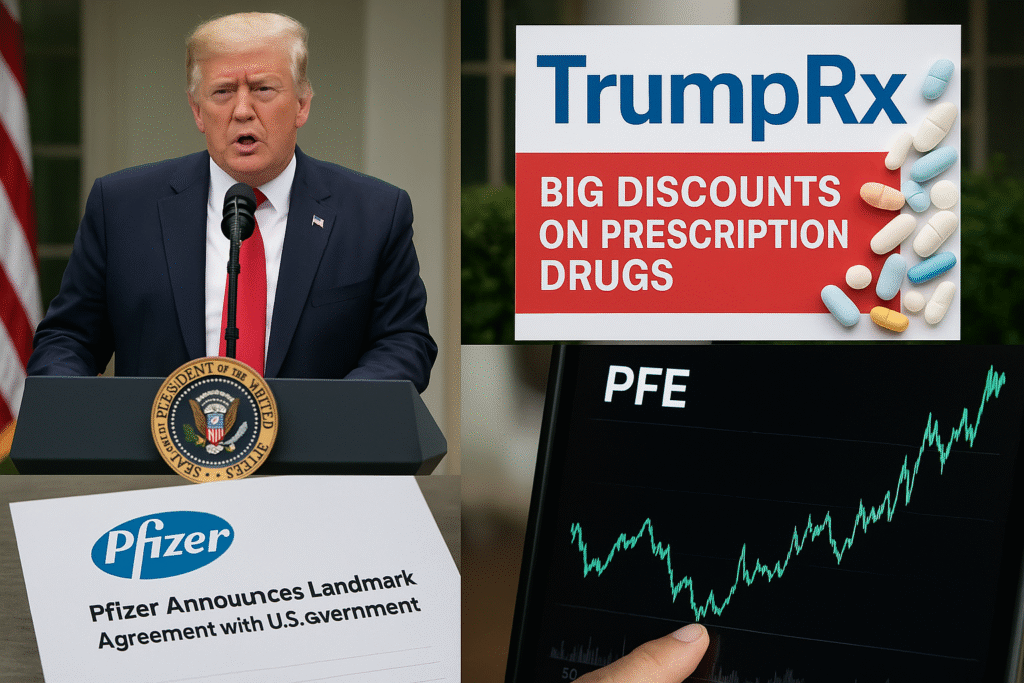

3) Why Pfizer’s stock moved (and how much)

Markets reacted immediately. On Sept. 30, Pfizer (PFE) shares rose sharply after the announcement — reflected in public quotes and trading data — because investors saw the deal as a way for Pfizer to avert tougher regulation while preserving predictable access to the U.S. market and gaining incentives for domestic investment. Morningstar, Yahoo Finance and Investing.com recorded intraday gains, and broader financial press described a multi-percent jump on the headline.

(Record: PFE closed near ~$23.85 on Sept. 29 and moved higher on Sept. 30; check investor pages for exact intraday numbers.)

4) What exactly did Pfizer promise about Medicaid prices?

A key point in the announcement: Pfizer said it would make many of its prescription medicines available to Medicaid at “most-favored-nation” prices (i.e., prices aligned with those paid in other developed countries). The administration pitched that as a way to reduce government drug spending and deliver lower costs to patients who rely on public programs. Pfizer’s press release and the White House fact sheet describe the offer as part of a negotiated package that includes investment commitments.

But experts quickly pointed out nuance: Medicaid already negotiates and obtains discounts under statutory rules (rebates and federal-state formulas), and the patients who benefit most from any new portal may depend on which drugs are included and how access is administered.

5) Which drugs (and which savings) are being touted?

The White House and administration briefings gave examples of large price reductions for specific branded treatments in public remarks — including claims of discounts up to 80% for selected drugs. Policymakers highlighted examples such as an eczema drug and other outpatient medications to illustrate the scale. However, the final, public list of drugs to be available on TrumpRx and the exact price schedules will determine who benefits. The administration claimed average discounts of roughly 50% across included categories in initial briefings.

6) What critics and independent experts immediately said

Major outlets and health-policy scholars flagged several concerns:

- Medicaid already pays relatively low prices for many medicines because of statutory rebates; therefore, the incremental savings for Medicaid could be small in many cases. Critics asked whether the “most-favored-nation” rhetoric overstated the practical savings.

- Distribution and access issues: Even if a portal sells drugs at a discount, patients with complex regimens (specialty injectables, in-clinic therapies) may not be able to shift easily to direct-to-consumer purchases.

- Long-term implications for innovation: Some analysts worry that price concessions tied to government incentives might reduce future R&D investment or lead to different price strategies abroad — a debate industry and economists have long argued.

In short: the deal looked big politically and symbolically, but experts said the ultimate benefit to patients depends on implementation details and which drugs are included.

7) Where Albert Bourla (Pfizer’s CEO) fits in

Albert Bourla — Pfizer’s CEO — appeared in the company statement and press materials describing the agreement as aligned with Pfizer’s commitment to bring medicines to patients and to invest in domestic manufacturing and R&D. Pfizer’s official release framed the arrangement as a partnership: discounts for patients in return for accelerated regulatory pathways and investment commitments. Bourla’s public comments emphasized investment in U.S. manufacturing and continued innovation as central goals.

8) Why the timing matters: M&A, Metsera and Pfizer’s growth story

Pfizer has been active in strategic deals in 2025 (for example, the reported Metsera acquisition in September 2025 to jump into obesity therapeutics), and management has been repositioning the company for new growth areas (vaccines, oncology, anti-obesity). The drug-pricing deal with the government gives Pfizer political cover and potential regulatory goodwill during a period of strategic re-investment — which is why investors were receptive to the headline.

9) How Medicaid, patients and insurers might actually feel the impact

- Medicaid programs: If the agreement truly places specified medicines at MFN-level prices for Medicaid, states could see lower expenditures on those drugs. But the scale depends on drug mix, utilization and rebate mechanics — and legal details about how the government implements MFN pricing matter.

- Patients on private plans: People covered by employer plans or Medicare Part D will not automatically get MFN Medicaid prices; the TrumpRx portal aims to provide discounted direct purchases for some patients, but uptake depends on consumer awareness and drug suitability for mail-order or self-administration.

- Specialty drug patients: Many high-cost specialty drugs (infusions, injectables given in clinics) are harder to route through a consumer portal, limiting the practical reach of direct-to-consumer discounts.

Bottom line: potential state Medicaid savings are plausible; widespread consumer savings hinge on implementation and which medicines are included.

10) The political & legal context — tariffs, leverage and incentives

The White House used the threat of tariffs and a national-security probe as leverage in its talks with drugmakers, offering regulatory and procurement incentives in exchange for voluntary price moves. That negotiating style — a mix of carrots (expedited reviews, procurement channels) and sticks (tariff threats) — is politically potent but also raises legal and trade considerations. Industry groups welcomed some aspects (predictability) and warned against overreach that could distort global pricing systems.

11) What to watch next — short checklist for readers

- Official drug list: which Pfizer medicines are actually included on TrumpRx and at what prices? The White House and Pfizer said a list would be published; that list will determine winners and losers.

- Regulatory documents: are any formal policy changes (beyond voluntary agreements) being enacted? Watch the Federal Register and HHS notices.

- State Medicaid guidance: state health agencies will explain how they integrate any MFN prices into benefit rules.

- Stock reaction follow-through: markets already moved; watch whether investor optimism holds as real pricing schedules and revenue forecasts are updated.

12) Bottom line — big headline, hard details

The TrumpRx / Pfizer announcement is a major political and corporate event: it pairs a presidential brand campaign (TrumpRx) with a major pharmaceutical company promising price concessions and U.S. investment. That combination produced an immediate market reaction and a flurry of media coverage. But the real story for patients and taxpayers depends on detailed lists, legal implementation, and whether discounts reach the broad categories of drugs that drive most spending. Experts urged caution: headline figures can look dramatic, but practical impact requires careful follow-through.

Verified primary sources & reporting (only authoritative, working links)

- White House — Fact Sheet: President Donald J. Trump Announces First Deal to Bring Most-Favored-Nation Pricing to American Patients (Sept. 30, 2025). (The White House)

https://www.whitehouse.gov/fact-sheets/2025/09/fact-sheet-president-donald-j-trump-announces-first-deal-to-bring-most-favored-nation-pricing-to-american-patients/ - Pfizer — Pfizer Reaches Landmark Agreement with U.S. Government to Lower Drug Costs for American Patients (Official press release, Sept. 30, 2025). (Pfizer)

https://www.pfizer.com/news/press-release/press-release-detail/pfizer-reaches-landmark-agreement-us-government-lower-drug

Disclaimer

This article summarizes public reporting and official releases as of September 30, 2025. It is informational and not financial, legal, or medical advice. For individual investment decisions consult a licensed financial advisor; for questions about prescription access consult your healthcare provider or state Medicaid office. Images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.