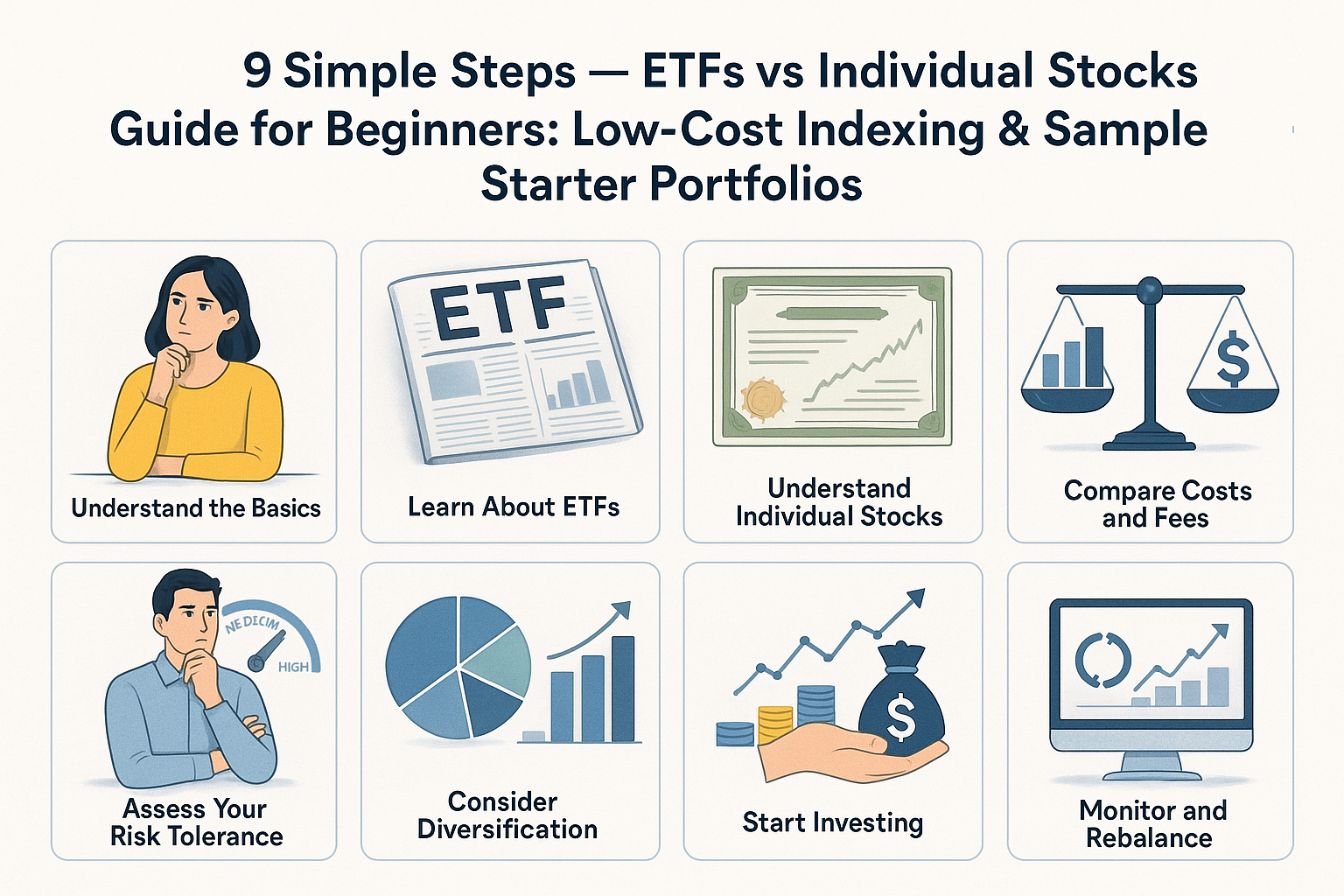

ETFs vs Individual Stocks Guide for Beginners: Investing can feel overwhelming the first time you log into a broker app. Two common choices you’ll see are individual stocks (buying shares of one company) and exchange-traded funds (ETFs) (buying a bundle of securities that trades like a stock). This guide — aimed at complete beginners — explains the differences, the pros and cons, how to pick low-cost ETFs, and gives three sample starter portfolios (conservative, balanced, aggressive) so you can get started with confidence.

Where helpful, I refer to official U.S. investor resources (SEC, FINRA, Investor.gov, IRS) so you can verify rules and learn more. (Investor.gov, FINRA, SEC)

1) What is an ETF

An ETF (exchange-traded fund) pools investors’ money to buy a basket of assets — stocks, bonds, commodities, or a mixture — and issues shares that trade on an exchange like a stock. ETFs are registered investment companies under federal securities laws and must provide prospectuses and disclosures. Because an ETF already holds many securities, one ETF share gives you instant diversification across dozens, hundreds, or even thousands of holdings. (Investor.gov, SEC)

Why beginners like ETFs: broad exposure with a single trade, usually low minimums, and often lower ongoing costs compared with many actively managed mutual funds. (Investor.gov)

2) How ETFs are similar to — and different from — individual stocks

Similarities

- Both trade on exchanges during market hours and have live bid/ask prices.

- Both can gain or lose value and are subject to market risk. (SSGA, FINRA)

Key differences

- Diversification: One share of an ETF generally spreads risk across many securities; one share of a stock concentrates risk in a single company. (FINRA)

- Management & objective: Many ETFs track an index (passive), though some are actively managed. Stocks represent ownership in a single company with company-specific risks. (Investor.gov)

- Tax efficiency: Because of the ETF creation/redemption mechanism, many ETFs are more tax-efficient than comparable mutual funds — meaning fewer unexpected capital gains distributions — though taxable events still occur when you sell. Tax treatment of ETF share sales follows the usual capital gains rules. Always confirm tax rules for your account type. (FINRA, Vanguard)

3) Costs that matter — how to compare ETFs and stocks

When comparing options, watch four cost components:

- Expense ratio (ETFs): annual management fee expressed as a percentage of assets. For index ETFs, this can be very low (many broad-market ETFs are well under 0.10%). Lower expense ratios compound into higher long-term returns. (Investor.gov)

- Brokerage commissions / trading cost: Many brokers now offer commission-free trades for ETFs and stocks, but check for odd-lot or broker-specific fees. Also watch bid/ask spreads — tight spreads matter more for frequently traded or small-cap ETFs. (Investor.gov)

- Tracking error (ETFs): the small difference between an ETF’s return and its index. Smaller tracking error is better for index ETF investors. (Investor.gov)

- Taxes: selling individual stocks or ETF shares triggers capital gains taxes. Mutual funds sometimes distribute capital gains to shareholders; ETFs by structure often minimize such distributions but are not tax-free. See IRS guidance on capital gains rules. (IRS, Vanguard)

4) Pros & cons — straight to the point

Buying ETFs — pros

- Instant diversification with one trade.

- Low cost for many index ETFs (low expense ratios).

- Ease of building a balanced portfolio (buy a few ETFs and get broad exposure). (Investor.gov)

Buying ETFs — cons

- Less upside potential than a winning single stock (but much lower single-name risk).

- Some niche ETFs (levered, inverse, commodity ETPs) carry extra complexity and risk — read the prospectus. (SEC)

Buying individual stocks — pros

- If you pick a future winner, returns can outpace broad indexes.

- You directly own the company — you can study its business, management, and earnings. (FINRA)

Buying individual stocks — cons

- High single-name risk: a bad earnings report or company event can wipe out a large chunk of value.

- Requires research, diversification across many stocks is costly and time consuming for small portfolios. (FINRA)

5) How to choose beginner-friendly ETFs (a checklist)

- Prefer broad, low-cost index ETFs — total-market or S&P-500-style funds are the easiest starting point. Look for expense ratios under 0.20% (many large providers are far lower). (Investor.gov)

- Check average daily volume & bid/ask spread — avoid tiny, illiquid ETFs that have wide spreads. (Investor.gov)

- Look at holdings and tracking error — a good ETF closely matches the index it tracks. (Investor.gov)

- Understand the fund structure — most retail index ETFs are open-end funds under the Investment Company Act (read the prospectus). Some ETPs (ETNs, commodity funds) carry different risks. Use SEC/Investor.gov resources to confirm structure. (SEC, Investor.gov)

6) Simple sample starter portfolios (no brand bias — categories only)

Below are three model portfolios for investors just starting. Use ETFs that represent each category (U.S. total market, international developed, emerging markets, aggregate bonds). Percentages are illustrative.

A. Conservative (for shorter horizons / capital preservation)

- 30% U.S. total stock market ETF

- 10% International developed ETF

- 10% Emerging markets ETF

- 50% U.S. aggregate bond ETF

B. Balanced (long-term growth + stability)

- 55% U.S. total stock market ETF

- 20% International developed ETF

- 5% Emerging markets ETF

- 20% U.S. aggregate bond ETF

C. Aggressive (long-term growth focus)

- 75% U.S. total stock market ETF

- 15% International developed ETF

- 10% Emerging markets ETF

- 0–5% bond ETF (optional for minimal stability)

How to implement

- Pick 1–2 ETFs that represent each category (low expense ratio, sufficient liquidity).

- Decide contribution cadence (monthly SIP / dollar-cost averaging).

- Rebalance once or twice a year back to target percentages. Rebalancing keeps risk in check. (FINRA)

Note: the exact allocation depends on your age, risk tolerance, and time horizon. These are educational examples, not personalized advice.

7) Buying strategy & practical tips for beginners

- Start with the basics: a broad U.S. equity ETF and an aggregate bond ETF is a perfectly reasonable two-fund starter portfolio. (Investor.gov)

- Use dollar-cost averaging: invest a fixed amount regularly to reduce timing risk and build disciplined habits.

- Mind taxes: keep tax-inefficient assets (taxable bond funds that pay interest) in tax-advantaged accounts and taxable, tax-efficient ETFs in brokerage accounts. Review IRS capital gains rules before selling. (IRS, Vanguard)

- Avoid frequent trading: turnover increases costs (spreads, potential taxes). For most beginners, a buy-and-hold approach with periodic rebalancing is best. (FINRA)

8) Where ETFs can surprise you (risks to watch)

- Levered & inverse ETFs: not suitable for buy-and-hold — they’re designed for short-term trading and can erode value over time due to daily rebalancing. Read the prospectus carefully. (SEC)

- Commodity and niche ETPs: these can have different tax treatments and structural risk (some are ETNs or not registered under the 1940 Act). Confirm structure and tax rules before buying. (Investor.gov)

- Bid/ask and liquidity in thin ETFs: small, specialized ETFs can have wide spreads that eat returns. Check average daily volume and spread. (Investor.gov)

9) Quick glossary (one-line definitions)

- Expense ratio: the yearly fee charged by the fund manager expressed as a percent of assets. (Investor.gov)

- Tracking error: the gap between the ETF’s return and the index it seeks to replicate. (Investor.gov)

- Bid/ask spread: difference between the highest price buyers pay and the lowest sellers accept — a trading cost. (Investor.gov)

- Creation/redemption mechanism: how authorized participants keep ETF share prices aligned with underlying net asset value; it’s also why ETFs are often tax-efficient. (SEC)

Final checklist before you buy

- Decide your long-term allocation (stocks vs bonds).

- Choose low-cost, liquid ETFs for each category.

- Open a brokerage account that offers commission-free ETF trades.

- Set up recurring purchases (monthly or per paycheck).

- Rebalance annually or when allocation drifts meaningfully.

Authoritative resources (official pages — verified active)

Below are official government or regulator pages you can use to verify concepts, read ETF/mutual-fund guides, and check investor protections. These were checked and are authoritative as of August 2025:

- Investor.gov — Exchange-Traded Funds (ETFs) (SEC investor education: what ETFs are and how they work). (Investor.gov)

https://www.investor.gov/introduction-investing/investing-basics/investment-products/mutual-funds-and-exchange-traded-2 - SEC — Investor Bulletin: Exchange-Traded Funds (ETFs) (detailed bulletin and PDF). (SEC)

https://www.sec.gov/investor/alerts/etfs.pdf - FINRA — Exchange-Traded Funds and Products (investor guidance on ETFs and related products). (FINRA)

https://www.finra.org/investors/investing/investment-products/exchange-traded-funds-and-products - SEC — Guide to Mutual Funds & ETFs (PDF) — overview of mutual funds and ETFs, fees, and investor questions. (SEC)

https://www.sec.gov/investor/pubs/sec-guide-to-mutual-funds.pdf - IRS — Capital Gains and Losses (Topic No. 409) — tax rules for capital gains from sales of securities (important to understand taxes when you sell ETFs or stocks). (IRS)

https://www.irs.gov/taxtopics/tc409

Disclaimer

This article is for informational and educational purposes only and is not investment advice. Investing involves risk, including loss of principal. Consult the official sources above and consider speaking with a licensed financial professional before making investment decisions. All images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.