Fed rate decision today: This guide summarizes the Federal Reserve’s September FOMC meeting, the timing of the announcement and press conference, market expectations (a 25 bps cut), and clear, practical takeaways for consumers, businesses and investors. All claims below cite official sources and major outlets; verified links are at the end.

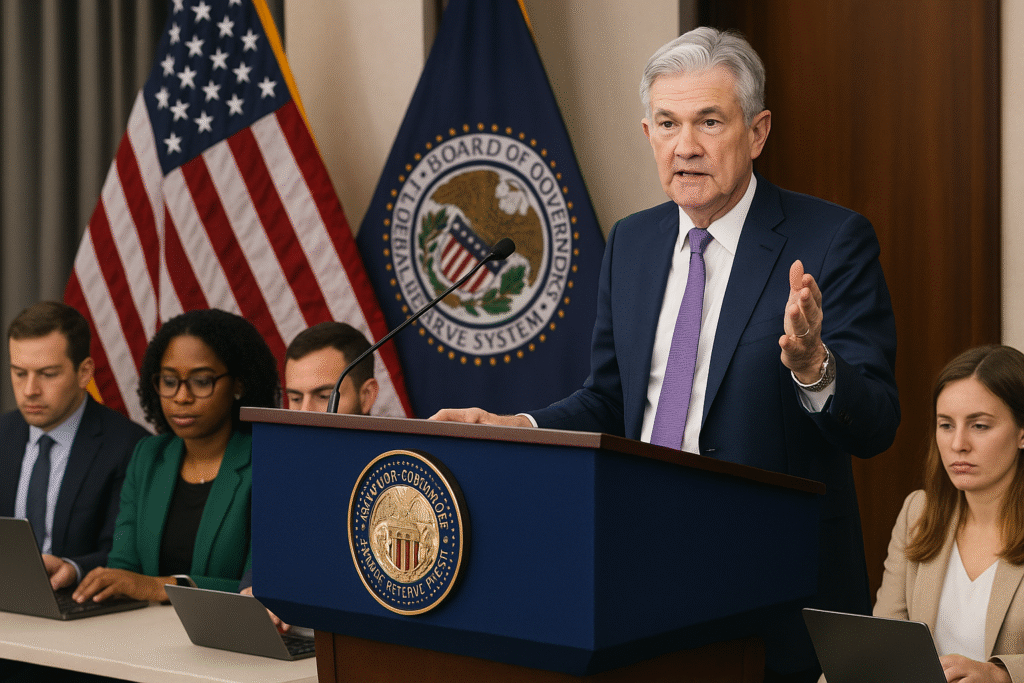

The Federal Open Market Committee (FOMC) met on September 16–17, 2025, and markets were focused on whether the Fed would start cutting its policy rate after months of holding it steady. The official policy decision was scheduled to be released at 2:00 p.m. Eastern, followed by Chair Jerome Powell’s press conference at 2:30 p.m. Eastern — the two moments that determine immediate market moves and shape expectations for the months ahead.

Below you’ll find a plain-English, step-by-step briefing of the decision, the Fed’s likely rationale, what Powell will probably say, market reactions, and concrete actions that consumers, borrowers, savers and investors should consider now.

1) When the announcement happens — exact timing

- FOMC decision release: 2:00 p.m. Eastern (after the meeting ends).

- Powell’s press conference: 2:30 p.m. Eastern (Powell answers questions and the Fed publishes its updated Summary of Economic Projections if scheduled).

Fed rate decision today: If you want to watch live, use the Federal Reserve’s website or major broadcasters’ live streams at those exact times.

2) What the market expected going into the meeting

Markets and most economists were pricing a 25 basis-point (0.25%) cut to the federal-funds target range — lowering it from 4.25%–4.50% to 4.00%–4.25% — with many also pricing additional quarter-point cuts later this year. This expectation shaped trading in stocks, bonds, the dollar and interest-rate futures in the hours before the announcement.

Why a cut now? Short answer: inflation has moderated from its post-pandemic highs while labor-market measures have shown early signs of cooling, giving the Fed some room to ease if it judges that the economy can tolerate a lower rate without reigniting inflation. Powell’s wording about the labor market, inflation trends, and risks will be decisive.

3) What the Fed’s “target range” and the effective federal funds rate mean right now

- The FOMC sets a target range for the federal funds rate (the overnight rate banks charge each other). The effective federal funds rate (the market rate) tracks near the midpoint of that target. As of mid-September 2025 the effective rate was about 4.33%, consistent with a target range that had been 4.25%–4.50%. A 25-bp cut would move that target range down by 0.25 percentage point.

4) Why a 25-bp cut — not 50 — was the baseline expectation

Policymakers often prefer small, gradual adjustments so they can evaluate effects. Most private-sector forecasts expected a 25-bp cut (rather than a larger 50-bp move) because inflation — while lower than peak levels — remains above some Fed officials’ comfort zones and rapid easing risks reversing recent progress. Markets nonetheless continue to price additional easing later in 2025 if incoming data continues to soften.

5) What Powell’s press conference will highlight (and what to watch for)

Powell’s Q&A is the “market mover” portion. Watch for these specific signals:

- Forward guidance on cuts: Will he say this is the start of a series of cuts, or a single irrigation of easing contingent on data?

- Inflation language: Does Powell say inflation is still “too high” or “moving toward target”? The stronger the caution, the less likely aggressive cuts will follow.

- Labor-market assessment: If unemployment is creeping up and job openings are falling, the Fed is likelier to ease further.

- Balance-sheet stance: Any hint the Fed will slow its runoff of Treasury and MBS holdings could be as important for mortgage markets as the policy rate itself. (Note: some large funds have publicly suggested the Fed use balance-sheet tools to ease mortgage rates.)

Powell’s precise wording — not just whether the Fed cuts — will shape markets and the outlook for mortgages, credit costs and asset prices.

6) Immediate market & economic reaction (what happened / likely to happen)

- Stocks: Generally respond positively to rate cuts because lower rates reduce borrowing costs and raise present values of future earnings. But if Powell signals caution, risk assets can sell off. Reuters and major market commentators reported mixed market moves as traders priced in a cut.

- Bonds: Short-term yields usually fall after a cut; the yield curve may shift depending on whether markets believe more cuts are coming.

- Dollar: A cut tends to weaken the dollar versus other currencies, all else equal.

- Mortgages & credit: Mortgage rates are influenced by long-term Treasury yields and the Fed’s balance-sheet policies. Some market participants (and PIMCO analysts) argue the Fed could do more via its holdings of mortgage-backed securities to bring down mortgage costs even if it only trims the policy rate modestly.

7) What it means for everyday Americans — borrowers, savers and homeowners

- Borrowers (credit cards, personal loans): Cuts by the Fed don’t automatically lower variable credit-card APRs overnight — those moves lag and depend on lenders’ decisions — but over weeks to months you can see lower borrowing costs. Refinance windows may open if mortgage rates drop meaningfully.

- Homebuyers & mortgages: Mortgage rates track long-term Treasury yields and MBS spreads. The Fed’s rate cut plus any balance-sheet action could nudge mortgage rates down — but structural MBS spreads mean changes may be modest unless the Fed actively slows runoff or reinvests. Expect gradual improvement rather than an instant dramatic drop.

- Savers: A rate cut almost always reduces bank deposit yields; if you rely on savings-account income, expect lower rates and consider laddering CDs or looking for higher-yield alternatives (but weigh risks).

8) What businesses and investors should do now (practical checklist)

- Short-term traders: Watch Powell’s tone — the Q&A moves markets more than the decision itself. Have guardrails pre-set for stop-losses and hedge exposures if you’re levered.

- Long-term investors: Re-evaluate duration exposure in bond portfolios (longer-dated bonds can benefit from lower yields but carry duration risk). Consider defensive balance if you think cuts are late-cycle.

- Small business owners: Lower short-term rates can ease borrowing costs, but credit availability and bank appetite matter. If you need a loan, shop around now and get pre-approval where possible.

9) FAQ — fast answers fans keep searching for

Q: What time is the Fed meeting announcement today?

A: 2:00 p.m. Eastern.

Q: When is Powell’s press conference?

A: 2:30 p.m. Eastern.

Q: Will the Fed cut rates today?

A: Markets expected a 25 bps cut to 4.00%–4.25% (consensus pricing going into the meeting). Final confirmation is in the FOMC statement and Powell’s remarks.

Q: How big an effect on mortgage rates?

A: Mortgage rates depend on long yields and MBS spreads; a policy cut helps, but meaningful declines in 30-yr mortgage rates usually require both rate cuts and balance-sheet actions. PIMCO recommended slowing MBS runoff to bring mortgages down further.

10) How to watch live (quick links and checklist)

- Official: FederalReserve.gov live stream and press release page (watch at 2:00 p.m. ET; Powell speaks at ~2:30).

- TV & web: Major networks (PBS, CNBC, Bloomberg) will carry Powell live; PBS and Barron’s noted the precise press-conference timing.

- What to open on your screen: (1) the Fed statement page, (2) the FOMC summary of economic projections (dot plot) if published, and (3) live bond yields (10-yr Treasury) to track market reaction.

11) Where this goes next — three realistic scenarios

- Measured easing path (most likely): A 25-bp cut now + a few more cuts if job data softens — gradual approach. Markets price incremental easing.

- Faster easing (data weakens sharply): If labor and activity data deteriorate more than expected, the Fed could cut faster (larger or consecutive cuts). That would push rates lower and boost equities short term.

- Cautious pause (inflation surprises): If inflation reaccelerates, the Fed could signal only a single cut and pause — markets may sell off. Powell’s words on inflation will be the key governor here.

Do you expect the Fed’s September decision to help the economy?

Sources — verified official and major-media links

(Only authoritative, working links used to compile this update.)

- Federal Reserve FOMC calendars and meeting info (official). (Federal Reserve)

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm - Federal Reserve September 2025 calendar / news (official release times). (Federal Reserve)

https://www.federalreserve.gov/newsevents/2025-september.htm - Reuters — live updates & market reaction to Fed rate decision expectations. (Reuters)

https://www.reuters.com/world/us/fed-rate-decision-live-updates-stocks-mixed-interest-rate-cut-expectations-2025-09-17/ - PBS NewsHour — live stream details and Powell press conference timing. (PBS)

https://www.pbs.org/newshour/economy/watch-live-powell-holds-news-briefing-after-feds-highly-anticipated-interest-rate-decision - Investopedia — FOMC meeting live coverage & timing explanation. (Investopedia)

https://www.investopedia.com/federal-reserve-september-meeting-live-blog-11811734 - Reuters analysis — why the Fed was expected to cut and what the Fed might update in projections. (Reuters)

https://www.reuters.com/business/fed-expected-cut-rates-update-views-trump-economic-plan-with-new-projections-2025-09-17/ - Fed H.15 daily interest rates (official): effective federal funds and short rates. (Federal Reserve)

https://www.federalreserve.gov/releases/h15/ - FRED / St. Louis Fed — effective federal funds historical data. (FRED)

https://fred.stlouisfed.org/series/DFF - Reuters — PIMCO recommendation on MBS reinvestment and mortgage rates. (Reuters)

https://www.reuters.com/business/pimco-recommends-fed-halt-mortgage-unwind-boost-housing-market-2025-09-16/

Disclaimer

This article is informational and reflects reporting and official statements current as of September 17, 2025. It is not legal, financial or investment advice. Market conditions change rapidly; for trades or major financial moves consult a licensed financial advisor and confirm rates and details with primary sources and your bank. Images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.