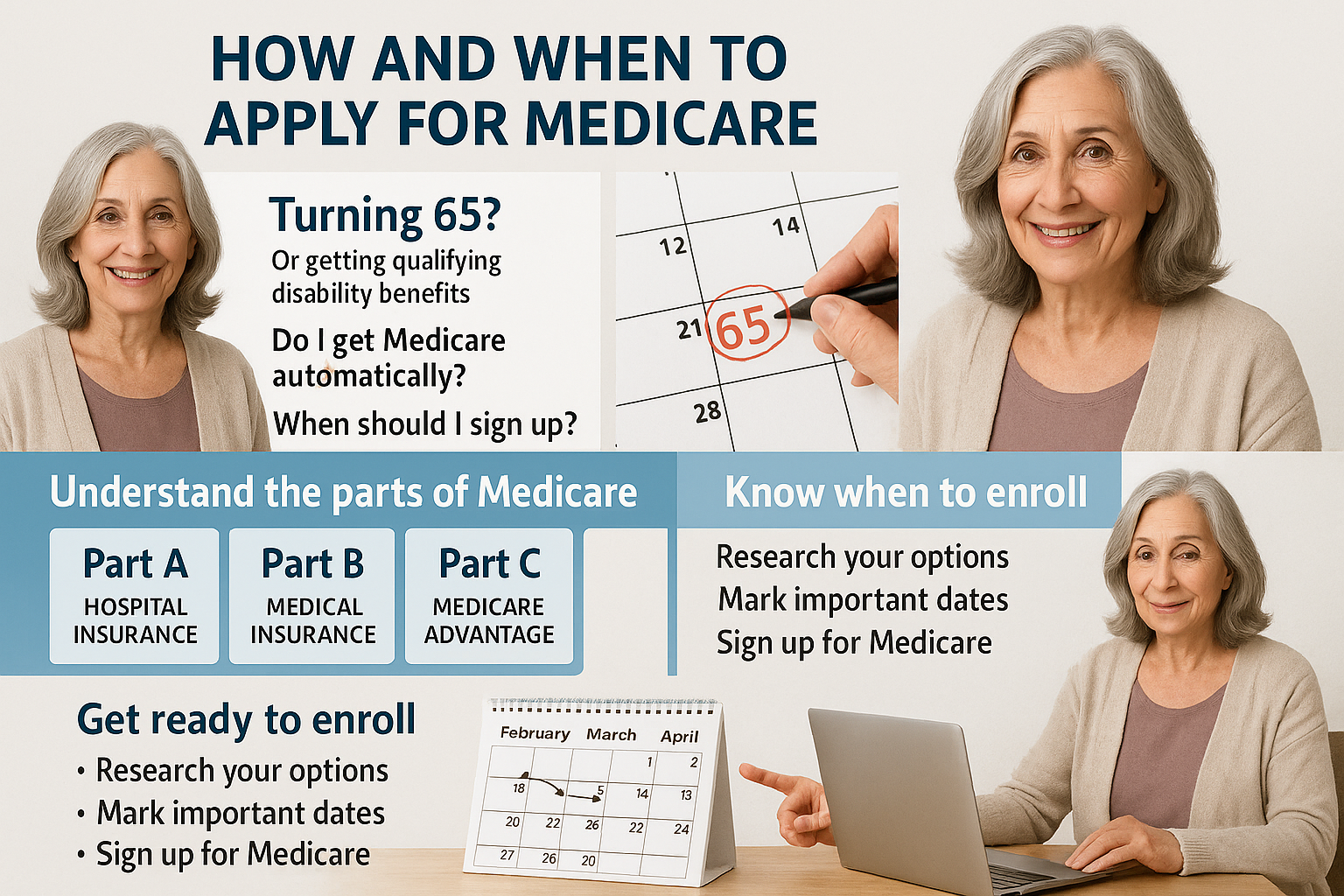

Turning 65 (or getting qualifying disability benefits) brings a lot of questions: Do I get Medicare automatically? When should I sign up? Which parts do I need? This friendly guide walks you through how and when to apply for Medicare, explains the four Medicare parts in plain language, shows the enrollment windows that matter, and gives practical, calendar-ready steps so you don’t miss deadlines or face penalties.

Quick primer — what Medicare is and the four parts

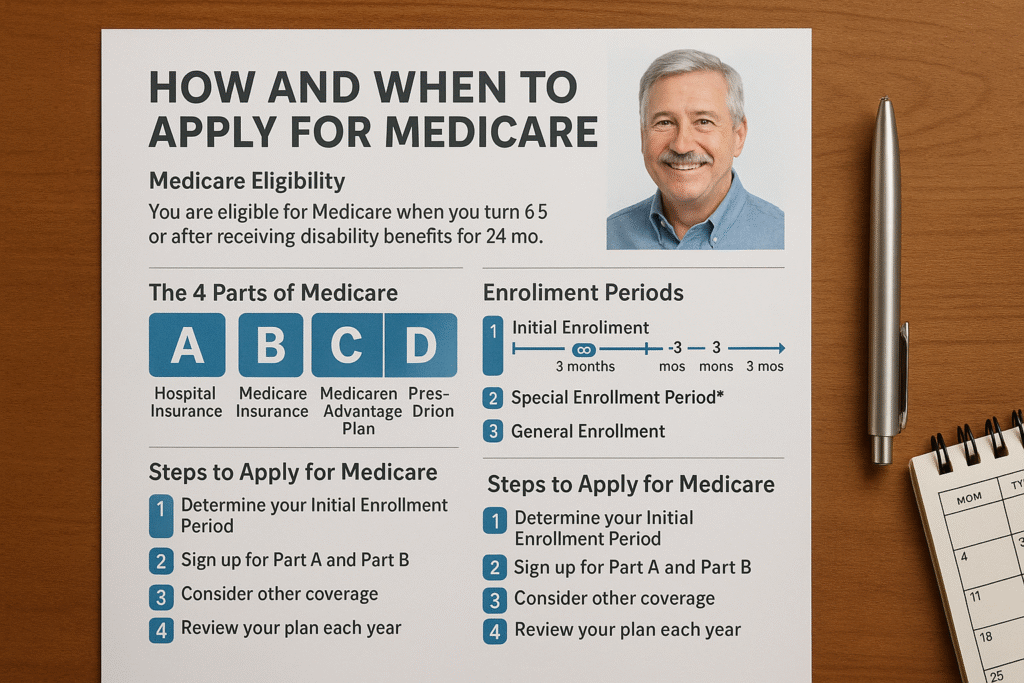

Medicare is the federal health insurance program primarily for people 65 and older, and for younger people with certain disabilities, End-Stage Renal Disease (ESRD), or ALS. The program is commonly discussed in four parts:

- Part A (Hospital Insurance) — covers inpatient hospital stays, skilled nursing facility care (short-term), hospice, and some home health services.

- Part B (Medical Insurance) — covers outpatient services: doctor visits, preventive care, durable medical equipment, and some home health services.

- Part C (Medicare Advantage) — private plans that bundle Part A and Part B (and often Part D); these plans may have networks and different cost structures.

- Part D (Prescription Drug Coverage) — plans that help pay for outpatient prescription drugs.

These parts interact in specific ways (for example, you generally need Part A and/or Part B to join a separate Part D drug plan or a Medicare Advantage plan). (Medicare)

When to sign up — the enrollment windows that matter

The timing rules are the most important part to avoid late-enrollment penalties:

- Initial Enrollment Period (IEP) — your first and most important window. It starts 3 months before the month you turn 65, includes your birth month, and ends 3 months after that month — a total of 7 months. Sign up during this window unless you have other credible coverage. (USAGov, Medicare)

- Automatic enrollment via Social Security — if you’re already receiving Social Security or Railroad Retirement Board benefits at least 4 months before turning 65, you will usually be automatically enrolled in Part A and Part B at 65; otherwise you must actively sign up. (CMS)

- Special Enrollment Period (SEP) — if you (or your spouse) work past 65 and you have health coverage through that employer, you can delay signing up for Part B without penalty. After employment ends, you have an SEP (generally 8 months) to enroll in Part B without a late-enrollment penalty. Check your employer plan details because rules differ for large versus small employers. (Medicare)

- General Enrollment Period (GEP) — if you miss the IEP and don’t qualify for an SEP, you can sign up during the GEP (January 1–March 31 each year), but Part B coverage won’t start until July 1 and you may owe penalties. (Medicare)

Missed IEPs can trigger permanent late-enrollment penalties, so mark your calendar and plan ahead.

Who gets Medicare before 65?

You may automatically get Medicare early if you:

- Are receiving Social Security disability benefits for 24 months (you get Medicare automatically after the 24-month waiting period), or

- Have ALS (you get Medicare as soon as you start receiving disability benefits), or

- Have ESRD (special rules apply; call SSA for enrollment instructions). (Medicare)

If any of these apply to you, the Social Security Administration (SSA) will usually notify you about benefit and coverage timing. (Medicare)

How to sign up — simple, secure options

You have three main ways to enroll in Medicare Part A and/or Part B:

- Online via Social Security — the fastest option for many people: create a secure “my Social Security” account and follow the Medicare sign-up steps. (Medicare)

- By phone — call Social Security at 1-800-772-1213 (TTY 1-800-325-0778) to sign up or get help.

- In person — visit your local Social Security office (appointments usually recommended).

If you already receive Social Security retirement benefits before turning 65, you typically don’t need to apply — enrollment often happens automatically. If you’re unsure, log in to your Social Security account or call SSA to confirm. (CMS, Medicare)

To join Medicare Advantage (Part C) or Part D (prescription drug) plans, you enroll through the Medicare Plan Finder at Medicare.gov or directly with the private plan during open enrollment windows (Annual Enrollment Period: October 15–December 7, with coverage starting January 1). (Medicare)

Practical, step-by-step checklist (start here — 6 actions)

- Set a calendar reminder: 3 months before your 65th birthday — that’s when your IEP opens. (Medicare)

- Decide whether you’ll keep employer coverage: If you (or your spouse) are still working and have group health coverage, talk to your HR benefits office about how enrolling in Medicare might affect that coverage and whether you’re eligible for an SEP later. (Medicare)

- Create a my Social Security account (if you don’t have one) — it’s the fastest online way to sign up. (Medicare)

- Gather documents: Social Security number, birth certificate (if needed), proof of current employer coverage (if delaying Part B), and military discharge papers if applicable.

- Enroll online or call SSA during your IEP (or use the SEP if applicable). Keep confirmation numbers and a copy of any application. (Social Security)

- Choose Part C/Part D if you need them — use the Medicare Plan Finder to compare costs, networks, and drug formularies before the Annual Enrollment Period if you want a Medicare Advantage or standalone drug plan. (Medicare)

Common questions (short answers)

Q: What if I miss my Initial Enrollment Period?

A: You may face a permanent Part B late-enrollment penalty (10% for each 12-month period you were eligible but didn’t sign up) unless you qualify for an SEP; you can enroll during the General Enrollment Period but with delayed coverage. (CMS)

Q: Do I need Part A if I’m still working?

A: Many people have premium-free Part A; even if you keep employer coverage, enrolling in Part A (if premium-free) can make sense. Consult your HR or benefits counselor. (CMS)

Q: How do I replace a lost Medicare card?

A: Request a replacement through your my Social Security account online or by calling/visiting SSA. (Social Security)

Q: Where can I get help choosing plans?

A: Contact your State Health Insurance Assistance Program (SHIP) for free, impartial counseling, or use Medicare.gov’s Plan Finder. (Medicare)

Where to go now — official resources & quick links

(Click these to verify details, enroll, or compare plans. Updated and checked as of Aug 2025.)

- USA.gov — How and when to apply for Medicare: https://www.usa.gov/medicare. (USAGov)

- Medicare.gov — Parts of Medicare & enrollment basics: https://www.medicare.gov/basics/get-started-with-medicare. (Medicare)

- Social Security — When to sign up & how to enroll online: https://www.ssa.gov/medicare/plan/when-to-sign-up and https://www.medicare.gov/basics/get-started-with-medicare/sign-up/how-do-i-sign-up-for-medicare. (Social Security, Medicare)

- CMS/Medicare publications & special enrollment guidance (forms & notices): https://www.cms.gov/ and CMS enrollment resources. (CMS)

Final tip — don’t gamble with deadlines

Medicare enrollment timing affects your coverage start date and whether you pay lifetime penalties. If you’re within a year of your 65th birthday (or already past it), take five minutes today: create or log into your my Social Security account, check your IEP dates, and plan whether to enroll now or delay because of work coverage.

Disclaimer: This post is for general informational purposes only and is not legal, financial, or medical advice. Verify enrollment rules, dates, and plan details on the official pages linked above or by calling the Social Security Administration or Medicare directly. All images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.