Shopping for health insurance can feel overwhelming — but the Affordable Care Act’s Health Insurance Marketplace is built to make coverage easier to compare, afford, and use. Whether you’re new to the Marketplace or renewing coverage, this friendly, step-by-step guide explains how to get insurance through the ACA Health Insurance Marketplace, who’s eligible, when to enroll, how financial help works, and where to get one-on-one assistance so you don’t miss deadlines or savings.

What the Marketplace does

The Marketplace (HealthCare.gov or your state’s exchange) lets you compare plans that must cover essential health benefits and can’t deny you for pre-existing conditions. Plans are grouped by metal tiers — Bronze, Silver, Gold, Platinum — that reflect how costs are split between you and the plan. The Marketplace also helps you see whether you qualify for premium tax credits and cost-sharing reductions to lower monthly premiums and out-of-pocket costs. (HealthCare.gov)

Who can use the Marketplace

You can enroll in Marketplace coverage if you:

- Live in the United States and are a U.S. citizen, U.S. national, or lawfully present;

- Are not currently incarcerated; and

- Want to buy individual or family coverage for yourself or dependents.

There’s no upper income limit for browsing plans, but eligibility for premium tax credits generally depends on your household income relative to the federal poverty level. The IRS and HealthCare.gov outline who qualifies for subsidies. (USAGov, IRS)

When to enroll — the key windows

- Initial/Open Enrollment Period: Each year you can enroll or change plans during Open Enrollment. For many states the window runs in the fall (HealthCare.gov lists dates; Open Enrollment timing may vary by state). If you enroll during OEP, coverage typically begins January 1 (or per your state’s schedule). (HealthCare.gov, healthinsurance.org)

- Special Enrollment Period (SEP): You may qualify for an SEP outside Open Enrollment if you experience a qualifying life event — for example: losing other health coverage, moving, marriage, having a baby, or changes in household income. Some low-income households may also be eligible for an SEP. Always check whether your life event qualifies before you apply. (HealthCare.gov)

- General Enrollment Period: If you miss the IEP and don’t have an SEP, the General Enrollment Period (yearly window) may let you sign up — but coverage will start later and you could face penalties depending on your situation. (CMS)

Tip: set a calendar reminder three months before your desired coverage start date so you don’t miss Open Enrollment deadlines. (HealthCare.gov)

How financial help works (premium tax credits & cost-sharing reductions)

Two big forms of savings are available through the Marketplace:

- Advance Premium Tax Credit (APTC) — lowers your monthly premium. If eligible, you can have the credit paid in advance to your insurer to reduce your monthly bill. You’ll reconcile actual income when you file taxes. Eligibility rules and income ranges are described by IRS/CMS guidance. (CMS, IRS)

- Cost-Sharing Reductions (CSRs) — lower your out-of-pocket costs (deductibles, copays) if your income falls within CSR ranges and you choose a Silver plan. CSRs don’t lower your premium directly but can dramatically reduce expenses when you need care. (HealthCare.gov)

Before you enroll, use the Marketplace estimator on HealthCare.gov to preview estimated premiums and savings for your household. (HealthCare.gov)

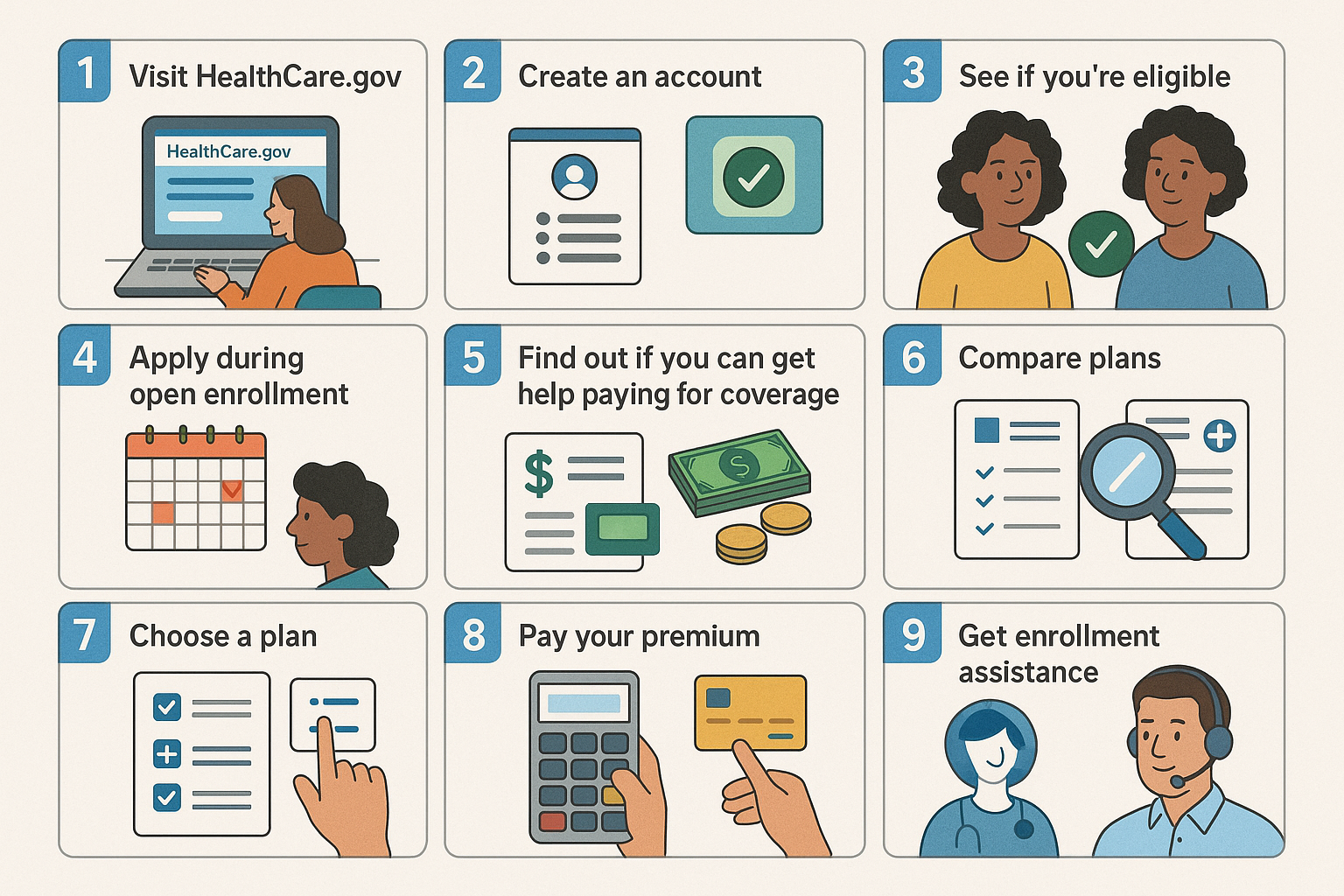

9 practical steps to enroll (follow this checklist)

- Gather documents. Have Social Security numbers (or document numbers if not a citizen), proof of income (pay stubs, W-2s, recent tax return), and dates of birth and addresses for everyone in your household. (HealthCare.gov)

- Check whether you qualify for Medicaid/CHIP first. Many people who apply to the Marketplace are directed to state Medicaid or CHIP instead if they qualify — those programs often have lower or no cost. (HealthCare.gov)

- Create an account on HealthCare.gov (or your state exchange) and start an application. You can usually save progress and come back if you need more documents. (HealthCare.gov)

- Estimate your income carefully. Your APTC and CSR amounts are based on your expected annual household income. If your income changes during the year, report it so your subsidy can be adjusted. (CMS)

- Compare plans by total cost, not only premium. Look at premiums plus deductibles, copays and provider networks — the Marketplace shows plan details and cost estimates for common care scenarios. (HealthCare.gov)

- Pick the right metal level. If you expect frequent care, a Gold or Platinum plan may cost more monthly but less at the point of service; Silver plans often work best if you qualify for CSRs. (HealthCare.gov)

- Enroll and pay your first premium. Coverage typically starts when your insurer receives the premium for your selected effective date. (HealthCare.gov)

- Submit any verification documents quickly. The Marketplace sometimes requests proofs (income, identity) — respond promptly to avoid enrollment delays. HealthCare.gov lists the documents and deadlines. (HealthCare.gov)

- Get local help if you need it. Certified navigators, assisters, and insurance agents/brokers can guide you through the process in-person or by phone. Use the Marketplace “Find Local Help” tool to schedule free assistance. (HealthCare.gov)

Where to get trusted help

If you prefer one-on-one support, search for local, Marketplace-certified help (navigators and assisters) on HealthCare.gov or call the Marketplace call center. If you’re buying a plan in a state-run exchange, use that state’s portal — links are on HealthCare.gov’s state page. (HealthCare.gov)

Quick FAQs

Q: Can I change plans mid-year?

A: Only during Open Enrollment or if you qualify for a Special Enrollment Period. Report life changes right away to see whether an SEP applies. (HealthCare.gov)

Q: Will Marketplace coverage cover pre-existing conditions?

A: Yes — insurers cannot deny or charge more for pre-existing conditions in Marketplace plans. (HealthCare.gov)

Q: What if I’m low income — should I apply for Medicaid first?

A: Yes — the Marketplace application screens you and will refer you to Medicaid/CHIP if you qualify. Medicaid often has no premiums and very low cost sharing. (HealthCare.gov)

Official links — click to apply or verify (checked Aug 2025)

- USA.gov — Marketplace overview: https://www.usa.gov/health-insurance-marketplace. (USAGov)

- HealthCare.gov — Marketplace home (create account, apply, compare plans): https://www.healthcare.gov/. (HealthCare.gov)

- HealthCare.gov — Estimate lower costs & learn about subsidies: https://www.healthcare.gov/lower-costs/. (HealthCare.gov)

- HealthCare.gov — Find local help (navigators & assisters): https://www.healthcare.gov/find-local-help/. (HealthCare.gov)

- CMS — APTC & cost-sharing reductions overview (technical): https://www.cms.gov/files/document/aptc-and-cost-sharing-reductions-overview.pdf. (CMS)

- IRS — Eligibility for the Premium Tax Credit: https://www.irs.gov/affordable-care-act/individuals-and-families/eligibility-for-the-premium-tax-credit. (IRS)

Disclaimer: This article provides general information about how to get insurance through the ACA Health Insurance Marketplace and is not legal, tax, or medical advice. Enrollment windows, subsidy rules, and state Marketplace details change from year to year — always confirm deadlines, eligibility, and exact subsidy amounts on the official pages linked above before you apply. All images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.

Nice blog.

Thank You for the acknowledgement.