Tax Solutions for Freelancers: Freelancing gives freedom — and also places the full tax burden on your shoulders. This guide turns that burden into a plan: clear steps for quarterly estimated tax, the most valuable deductible expenses, tax-saving retirement options, and recordkeeping tips so you can keep more of what you earn — legally and sustainably. Everything below is written for U.S. freelancers and cited to official IRS guidance where it matters most.

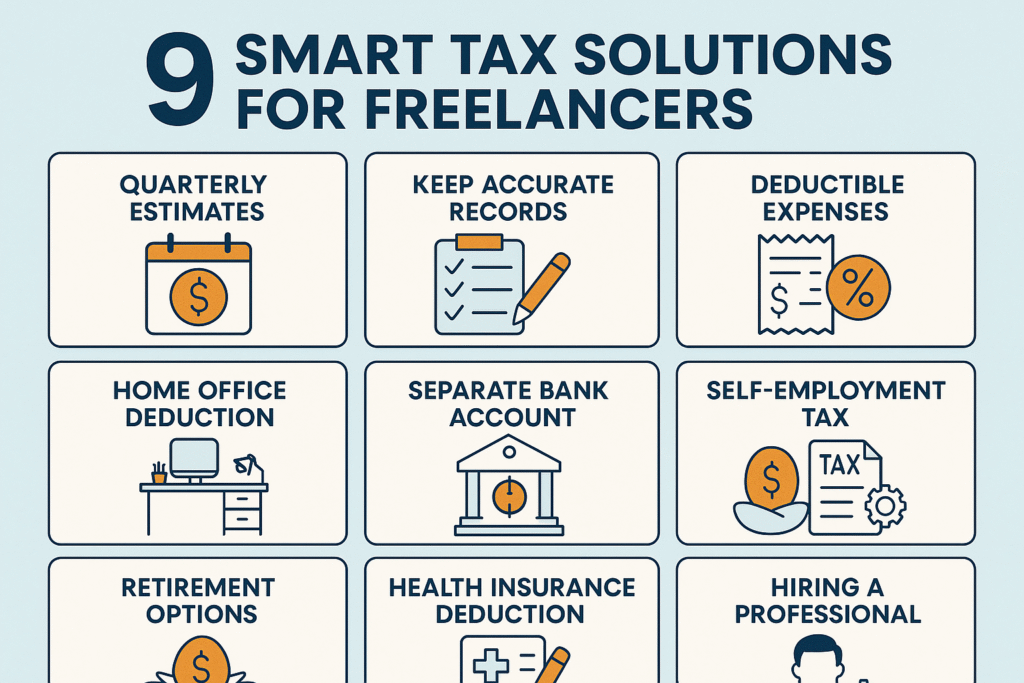

Quick roadmap (what you’ll learn)

- Why freelancers must understand estimated tax and self-employment tax. (IRS)

- How to calculate and pay quarterly estimated taxes (Form 1040-ES). (IRS)

- The deductible expenses that cut taxable income the most (and documentation rules). (IRS)

- Tax-efficient retirement options for freelancers (SEP IRA, Solo/Individual 401(k), SIMPLE). (IRS)

- Specialty deductions: self-employed health insurance, home office, vehicle use, and the QBI deduction basics. (IRS)

- A practical checklist to implement this month.

1) The two tax realities every freelancer must accept

- You pay income tax on net profit (income minus allowable business expenses) — and that tax is due even if no employer withheld anything.

- You pay self-employment tax (the Social Security and Medicare portion that employers normally split with employees). The combined self-employment tax rate is generally 15.3% (12.4% for Social Security up to the wage base, plus 2.9% for Medicare). You compute it using Schedule SE when you file. (IRS)

Why this matters: you must both estimate and pay not only income tax but also the employer-equivalent share of payroll taxes quarterly to avoid penalties.

2) Quarterly estimated tax — the how and when (step-by-step)

If you expect to owe $1,000 or more in tax after withholding and refundable credits, the safe play is to make quarterly estimated payments. Here’s a simple workflow:

- Start with last year’s return — use it as a baseline. The Form 1040-ES worksheet helps you estimate 2025 taxes and payment amounts. The IRS package includes worksheets and vouchers for each quarter. (IRS)

- Include self-employment tax when estimating: the Form 1040-ES worksheet has a Self-Employment Tax and Deduction Worksheet to help you adjust for the Medicare/Social Security component. (IRS)

- Watch the four payment deadlines (typical U.S. schedule): mid-April, mid-June, mid-September, and mid-January of the following year (confirm exact dates each year). If you miss a payment, the IRS may assess an underpayment penalty; making accurate estimates or using safe-harbor rules helps avoid penalties. (IRS)

- Pay online — the IRS Direct Pay, EFTPS, or the “Pay Estimated Tax” option let you pay electronically and track payments. (Electronic payment is faster and safer than mailing vouchers.)

- Adjust as you go — if income changes, run a fresh Form 1040-ES worksheet and increase or decrease the next quarter’s payment. Overpaying is an interest-free loan to the IRS; underpaying triggers penalties.

Pro tip: For very variable monthly income, estimate conservatively for early quarters and update midyear with a revised worksheet to avoid a large final payment.

(Authoritative note: use the official Form 1040-ES and the IRS estimated tax pages to compute exact amounts and find payment options). (IRS)

3) The deductible expenses that matter most (and documentation)

The single most important lever to lower your freelance tax bill is legitimate business expense deduction. The IRS maintains a guide to business-expense resources that maps the rules and examples you need. Key categories:

- Home office deduction — if you use part of your home regularly and exclusively for business, you may take the simplified or regular home office deduction (square footage × rate or actual expense allocation). Keep floor-plan proof and a consistent method. (IRS)

- Supplies and equipment — everything from software subscriptions and laptops to minor office supplies is deductible when ordinary and necessary for your trade. Large equipment may be depreciated or deducted under Section 179 if eligible. (IRS)

- Mileage and vehicle costs — choose either the standard mileage rate or actual expenses (fuel, maintenance, depreciation) — track business miles carefully with a contemporaneous log. (IRS)

- Home Internet, phone, and utilities — allocate the business percentage and deduct that portion.

- Marketing, education, professional fees, insurance, subcontractor fees — ordinary business operating costs are deductible.

- Business meals & travel — rules have nuances (partial deductibility), so keep receipts and note business purpose and attendees. (IRS)

Documentation rule: if you can’t produce a receipt or contemporaneous record that shows the business purpose/amount/date, the IRS may disallow the deduction. Use a dedicated business bank account and bookkeeping software to maintain a clean audit trail.

4) Retirement vehicles that lower taxes and boost savings

Retirement accounts are among the best tax-savings tools for freelancers — they reduce taxable income now while helping secure retirement.

- SEP IRA — Simple to set up and very flexible: you (as “employer”) contribute up to the smaller of 25% of compensation or the annual dollar cap (increased periodically). It’s attractive when income varies because you set contributions year to year. (IRS)

- Solo / One-participant 401(k) (a.k.a. Solo 401(k) or Individual 401(k)) — lets a self-employed person contribute both as employee (elective deferral up to the employee limit) and as employer (profit-sharing up to the overall limit). For many freelancers this lets you save more each year than a SEP alone. See IRS guidance on one-participant plans for exact contribution rules. (IRS)

- SIMPLE IRA — lower contribution limits but simpler administrative rules if you have a small business with employees.

- Traditional & Roth IRAs — useful for additional, smaller-dollar retirement contributions; income phase-outs apply for Roths and deductibility rules for traditional IRAs if you’re covered by another plan.

Which to pick? If you want maximum current-year deductible savings and may have high taxable income some years, the Solo 401(k) often yields the largest immediate tax reduction; SEP IRAs are best for flexibility. Check IRS pages or a tax advisor for contribution limits and plan-setup steps. (IRS)

5) Specialty deductions & credits freelancers should not miss

- Self-Employed Health Insurance Deduction — you may be able to deduct premiums you pay for medical, dental, and qualified long-term care insurance for yourself, spouse, and dependents. There’s a specific Form/worksheet to compute the allowable amount. Keep insurance statements and premium receipts. (IRS)

- Qualified Business Income (QBI) deduction (Section 199A) — many sole proprietors and pass-through business owners can claim up to 20% of qualified business income, subject to limitations and phase-outs for certain service businesses or at higher income levels. This is a significant potential deduction — confirm eligibility and computation rules before claiming. (IRS)

- Estimated tax safe-harbor rules — if you pay 90% of the current year’s tax or 100% (110% for higher incomes) of the prior year’s tax in timely estimated payments, you generally avoid underpayment penalties. Use these safe-harbors when income is unpredictable. (IRS)

6) Recordkeeping: your defense and advantage

- Separate accounts: use a business checking account and business credit card; never mix personal and business funds.

- Scan everything: keep digital copies of receipts, invoices, contracts, and mileage logs. Many mobile apps capture receipts and tag business purpose automatically.

- Quarterly bookkeeping review: reconcile bank accounts and run an estimated-tax projection monthly so you never face a surprise bill in April.

- Hire a bookkeeper if you’d rather spend time on clients — the small monthly cost often outweighs missed deductions and penalties.

7) Practical checklist — what to do this month

- Open a dedicated business bank account and credit card (if you don’t have one).

- Download Form 1040-ES and complete the worksheet to compute your next estimated payment; schedule payments for the quarter. (IRS)

- Set up bookkeeping (simple cloud software) and record all income/expenses for the quarter.

- Compare retirement options and, if feasible, open a SEP IRA or Solo 401(k) before the tax-deadline to capture deductible contributions for the year. (IRS)

- If you pay for your own health insurance, gather premium invoices and check the Form 7206 rules to claim the self-employed health insurance deduction. (IRS)

8) Common freelancer mistakes to avoid

- Underpaying estimated taxes and then scrambling to cover a huge April bill.

- Failing to track mileage and business use — you lose deductible value if you can’t prove it.

- Treating retirement options as optional — they both lower tax and build retirement savings.

- Using the wrong safe-harbor — if you are high-income, the 110% prior-year safe harbor may apply; check the rules.

9) When to get professional help

- Your business is growing fast and you’re unsure whether to incorporate (S-Corp vs. LLC vs. sole proprietor).

- You have complex pass-through income and think you may qualify for the QBI deduction — the computation can be tricky. (IRS)

- You are negotiating employee vs. contractor status with workers or clients.

A CPA or enrolled agent with small-business experience will often pay for themselves by finding additional deductible opportunities and optimizing estimated-tax strategy.

Authoritative government resources (verified Aug 2025)

(Use these pages to cross-check rules, download forms, and follow official worksheets.)

- Form 1040-ES (2025) — Estimated Tax for Individuals (PDF & worksheets). (IRS)

https://www.irs.gov/pub/irs-pdf/f1040es.pdf - Estimated taxes — IRS (Small Business & Self-Employed) — how to figure and pay estimated tax. (IRS)

https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes - Self-employment tax (Social Security and Medicare) — Schedule SE overview and rules. (IRS)

https://www.irs.gov/forms-pubs/about-schedule-se-form-1040 - Guide to business expense resources — IRS (mapping of resources after Publication 535 was discontinued). (IRS)

https://www.irs.gov/forms-pubs/guide-to-business-expense-resources - Retirement plans for self-employed people (Solo/One-participant 401(k) & other plans). (IRS)

https://www.irs.gov/retirement-plans/retirement-plans-for-self-employed-people - SEP contribution limits (annual limits & rules). (IRS)

https://www.irs.gov/retirement-plans/plan-participant-employee/sep-contribution-limits-including-grandfathered-sarseps - Form 7206 / Self-Employed Health Insurance Deduction resources. (IRS)

https://www.irs.gov/forms-pubs/about-form-7206 - Qualified Business Income (QBI) deduction — IRS overview & news. (IRS)

https://www.irs.gov/newsroom/qualified-business-income-deduction

Short legal & tax disclaimer

This article is for informational purposes only and does not constitute legal, tax, or financial advice. Tax rules and limits change; consult the official IRS pages above and consider speaking with a qualified CPA or tax professional before making tax-sensitive decisions. All images used in this article are royalty‑free or licensed for commercial use and are provided here for illustrative purposes.